You may remember back in May when a Chicago resident tweeted about her property management company being OK with moldy apartments. That resident, Amanda Bonnen, was subsequently sued by Horizon Group Management for publishing a false and defamatory tweet on Twitter May 12.

The tweet read: “Who said sleeping in a moldy apartment was bad for you? Horizon realty think it’s okay.” Those two sentences sparked the suit in which Horizon sought $50,000 in damages, mostly reputation-related. The case was eventually dismissed this past January, with the judge claiming the tweet was “too vague to meet the legal standards of libel.”

Though it was dismissed, this one lawsuit opened the door to Twitter-related legal action. Soon to follow? Most likely lawsuits related to Facebook posts. Not only can tweeting or posting about another company get you in trouble, doing the same about the company for which you work can also pose a risk. As an article on MainJustice.com states:

“Our board members are talking about things like Facebook and Twitter, so we are definitely paying attention to social media,” said Haydee Olinger, the chief compliance officer for McDonald’s Corporation. Grace Renbarger, the chief ethics and compliance officer for Dell Computer, said she is constantly worried that something her employees say on Facebook or Twitter could hurt the company. “You don’t want people out there saying things that could be attributed to the company for liability purposes,” Renbarger said.

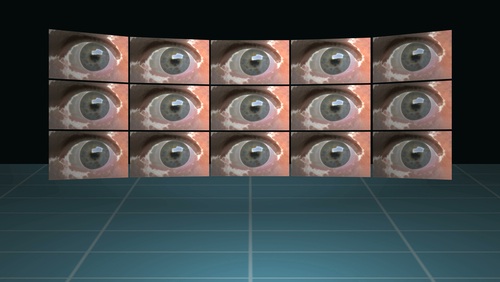

Because of the risk social media poses, the role of the chief compliance officer has grown to encompass the occasional or, in some cases, often, monitoring of employee’s Facebook and Twitter accounts. Tweeters and posters beware: big brother is watching!