In our April issue (which will be available online tomorrow available now), we feature an article about how the Consumer Product Safety Commission (CPSC) is ramping up its enforcement efforts of late. Our May issue will discuss how OSHA is doing the same. And this post last week talks about how the EPA is planning to re-new its mission to safeguarding the nation’s drinking water.

Will the FDA be the next watchdog to flex its muscle?

Some think it should, specifically when it comes to “food fraud.”

Increasingly, companies, retailers and consumers are pressuring the U.S. Food and Drug Administration (FDA) to act on the rising incidence of food fraud, the Washington Post reports.

Examples of food being mislabeled abound: “sheep’s milk” cheese really being made from cow’s milk; “Sturgeon caviar” being Mississippi paddlefish; grouper, red snapper and flounder actually catfish fillets from Vietnam; and honey diluted with sugar beets or corn syrup sold as 100 percent pure.

This type of “food fraud” has been found in fish, fruit juice, maple syrup, olive oil, spices, spirits, vinegar and wine. Those affected by the fraud include consumers and companies such as E&J Gallo and Heinz USA.

Rhetorically, the FDA definitely wants to increase its ability to monitor such violations, but the past few years have seen so many incidents of rampant — and at times deadly — food quality issues that the regulator has instead focused on that side of things.

And rightly so. I mean, look at this list of recalls in just November 2009 alone.

Still, one issue being more troubling doesn’t mean that the other one isn’t also a threat.

“We put so much emphasis on food and purity of ingredients and where they come from,” said Mark Stoeckle, a physician and DNA expert at Rockefeller University. “But then there are things selling that are not what they say on the label. There’s an important issue here in terms of economics and consumer safety.”

The CPSC and OSHA have both needed more funding and resources to expand their mission. Does the FDA deserve the same? In a vacuum, of course. And food fraud has the potential to cause some very serious health and safety problems.

But in a still-shaky economy and with a new, historic commitment to health care, can every agency in Washington really expect to get a higher budget?

Brushing your teeth has never been so delicious … Hey! Wait! That’s not tooth paste.

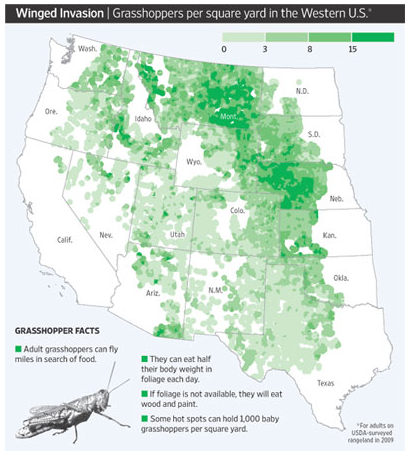

2010 may, unfortunately, become the year of the grasshopper, just as 2005 was the year of the locust. In that year, locusts devastated farms and agricultural businesses from western Africa to eastern Australia, a topic

2010 may, unfortunately, become the year of the grasshopper, just as 2005 was the year of the locust. In that year, locusts devastated farms and agricultural businesses from western Africa to eastern Australia, a topic