Munich Re was very happy to recently announce that billionaire Warren Buffett has invested even more money in the company. He now holds a 3.045% stake in the company and news of the investment boosted share price by 2%.

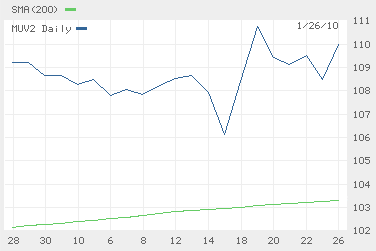

A 30-day view of Munich Re's share price, compared to the 200-day simple moving average.

In early 2008, Buffett’s investment company, Berkshire Hathaway, bought a 3% stake in Swiss Re. During the U.S. subprime crisis, the company helped rescue Swiss Re from financial trouble with a major loan, helping to strengthen the reinsurance company’s balance sheet.

Berkshire Hathaway itself has reinsurance operations, Berkshire Hathaway Re, which is among the largest three reinsurers worldwide by gross premium income. Buffett has repeatedly said in the past that he isn’t eyeing a takeover of the Swiss company. However, during the past two years, Swiss Re and Berkshire have entered several reinsurance deals, raising speculation that the two firms could merge at some point.

Buffett is no stranger to the reinsurance market. Berkshire Hathaway owns Berkshire Hathaway Re, one of the largest three reinsurers worldwide in terms of gross premium income. Berkshire also owns various other insurance companies, including GEICO, which it acquired in 1996, General Re, which it acquired in 1998, NRG (Nederlandse Reassurantie Groep), which it bought in 2007 and Berkshire Hathaway Assurance, a government bond issuance company.

Similar Posts:

- Warren Buffett Urges More Insurance Underwriting Discipline, Fewer “Testosterone-Driven” Decisions

- Munich Re: Scientifically Proving Climate Change Affects Thunderstorm Losses

- Betting on Catastrophes

- More Catastrophe Bonds Issued in First Half of 2012 Than Any Year Since 2007

- ILS Roars into 2017 as Maturities Loom

That Berkshire Hathaway is invested in its competitors says something about the recursive nature of the reinsurance market. It’s a bit like being at the end of the universe; there’s no re-reinsurance market for the reinsurance market, except for the reinsurance market itself, so what Buffett is doing makes sense, but perhaps only to those who understand the apparently nonsensical nature of the reinsurance market.

Also, it’s nice to see Munich Re get a boost (as well as Swiss Re). Both are firms with a lot to offer, especially in terms of content. Munich Re’s Schaden Spiegel is a fascinating look at large losses and I have been a reader of Swiss Re’s sigma for a long while. Both also produce no small number of great reports and topics. Check out their booths at the RIMS conference for whatever they have most recently released. It never disappoints.

I wonder why Warren Buffett never comments on his investment in Munich Re. His only comments in this regard referred to the fact that Munich Re is a trading position and not a core investment, but this does not explain why he bought shares.