From left: Massimo Sterpi, Elena Zavelev, Anne Bracegirdle, Devin Finzer, Curt Bilby / Photo: Keith Sherman & Associates

NEW YORK—On May 21, the Observer’s inaugural “Business of Art Observed” event brought experts in art, insurance, risk management, tech and finance to the Roosevelt Hotel to discuss established and emerging risks facing the $50 billion art industry.

The “Insurance and Risk Management” session wasted no time exploring creative risk and claims management approaches to the various forms of potential damage to artwork. From transit to security to geopolitical risk, panelists agreed fine art coverage is not a paint-by-numbers process, and said the “framing of a claim” can facilitate a payment.

“Insurance companies get a bad reputation,” said Mary Pontillo, senior vice president and national fine art practice leader at DeWitt Stern. “But the higher-end, really good-quality insurance companies are looking for ways to pay claims. I think that’s where there are a lot of misconceptions.”

For example, she mentioned advising a client whose work was being kept on a yacht. While certain maritime and environmental risks such as humidity were not covered by the policy, she was able to demonstrate that ocean spray had been the source of the damage and successfully get the claim covered.

The session discussed modernizing risk management in the art market and how the industry should apply forensic due diligence to transactions and ensure they view all business activities through a lens of strategic risk. And with transparency cited as a continuous challenge, Dennis Wade, a senior partner at Wade Clark Mulcahy, LLP, who has handled international fine art matters, pointed out the importance of reputation risk when drafting a policy.

“Many policies also contain an exclusion for the dishonesty of the person to whom you deliver or entrust the goods,” Wade said. “So if you consign a work to a corrupt gallerist, there may be an exclusion in your policy and you may not be covered at all.”

The emergence of blockchain technology dominated discussion at another session, “Art Market 2.0: Using Art & Technology to Drive the Industry Forward.” According to panelists, authentication and secure transactions have risen to the top of their risk registers. New Art Academy Founder Elena Zavelev said blockchain’s ability to put individual faces on digital artwork has mostly solved the prior risk of unauthorized duplications, forgeries, and fraud. Zavelev and her co-panelists said blockchain may facilitate a long-term change in the way art is created, sold, curated and insured by improving the ability to track a work’s provenance.

Christie’s AVP Anne Bracegirdle said the masterstroke for streamlining the authentication process is to create a digital, industry-wide registry. Tokenizing original works, she said, would simplify the experience of buying, selling and trading. “If each piece had its own digital identity that would stay the same, no matter where it went, it would instantly provide secure provenance and prices,” Bracegirdle said. “There are companies like Consensus and Microsoft working to create distributed identity networks. The security within that could be applied to scale blockchain—regardless of which blockchain you’re interacting with. Digital identities would provide clients with access to all their consignments and their purchases in one consolidated space, which currently doesn’t exist.”

The evolution of art was also a hot topic during this session since what’s considered a “finished piece” is no longer just a physical canvas. Digital, virtual and even crypto-art may be in their relative infancy but these are gaining global popularity and could significantly influence the industry, said Devin Finzer, co-founder and CEO of OpenSea, a peer-to-peer marketplace for crypto collectibles, gaming items, and digital art.

“[Owning digital products] has always been confined to a specific ecosystem, like event tickets to a ticketing site,” Finzer said. “Blockchain offers a new type of ownership for these digital assets and it’s exciting for digital art because you can own it in a variety of [digital forms]. Right now, we see the enthusiasm is from tech enthusiasts, but I think over time these ideas around digital ownership will cross over to a mainstream crowd who appreciate the art more than the technology.”

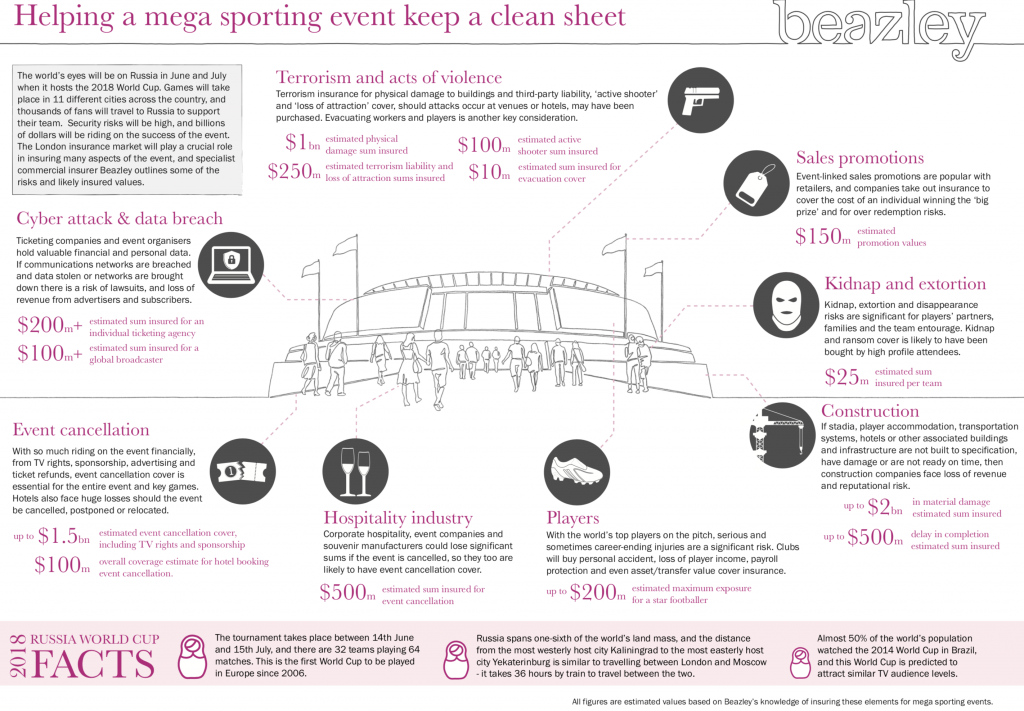

Above: Luzhniki Stadium in Moscow

Above: Luzhniki Stadium in Moscow