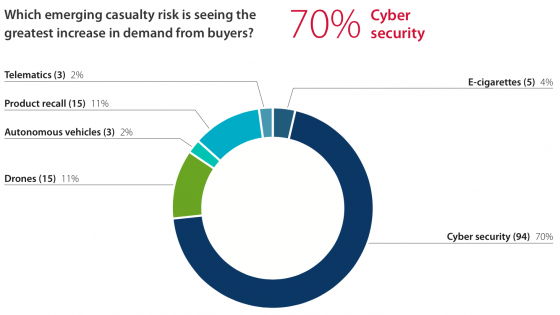

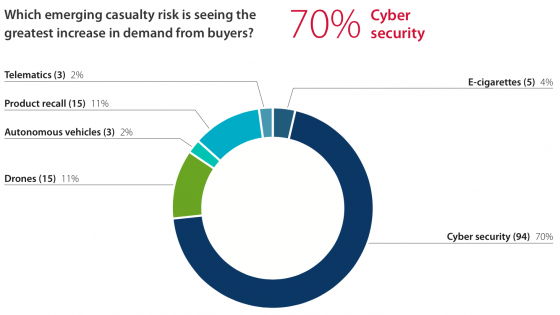

The cybersecurity insurance industry is booming, with demand for this specialty coverage vastly outpacing any other emerging risk line, according to a new survey by London-based broker RKH Specialty. In fact, 70% of the insurance professionals surveyed listed cyber as the top casualty exposure.

The brokers, agents, insurers and risk managers RKH queried after April’s RIMS 2015 conference said their top casualty concerns after cyber are product recall and drones (11% each), with others including e-cigarettes, autonomous vehicles and telematics totaling only eight percent.

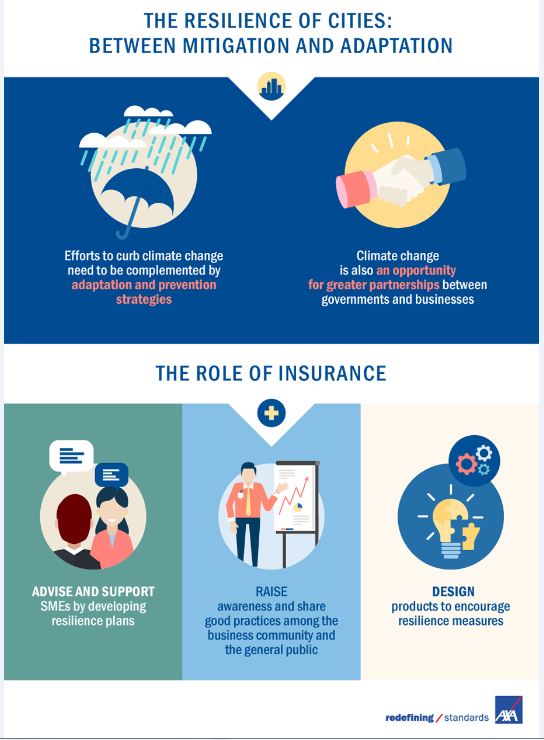

“Losses stemming from cyber-related attacks and business interruption can be catastrophic for individual businesses,” said Barnaby Rugge-Price, RKH Specialty’s CEO. “Healthcare and retail have been the major buyers in the cyber space to date but we are seeing an increasing conversion rate across the whole of our portfolio. After a number of years of looking at the offering, clients are increasingly deciding to purchase the cover as the product has improved and the frequency of attacks has continued to increase. There has also been a heightened focus on the business interruption aspect, where cyber attacks can cause whole facilities to shut down. But whether cyber related or not, any interruption to the supply chain can cause a disproportionate loss. The survey highlights the importance of specialist insurance for a whole host of emerging risks.”

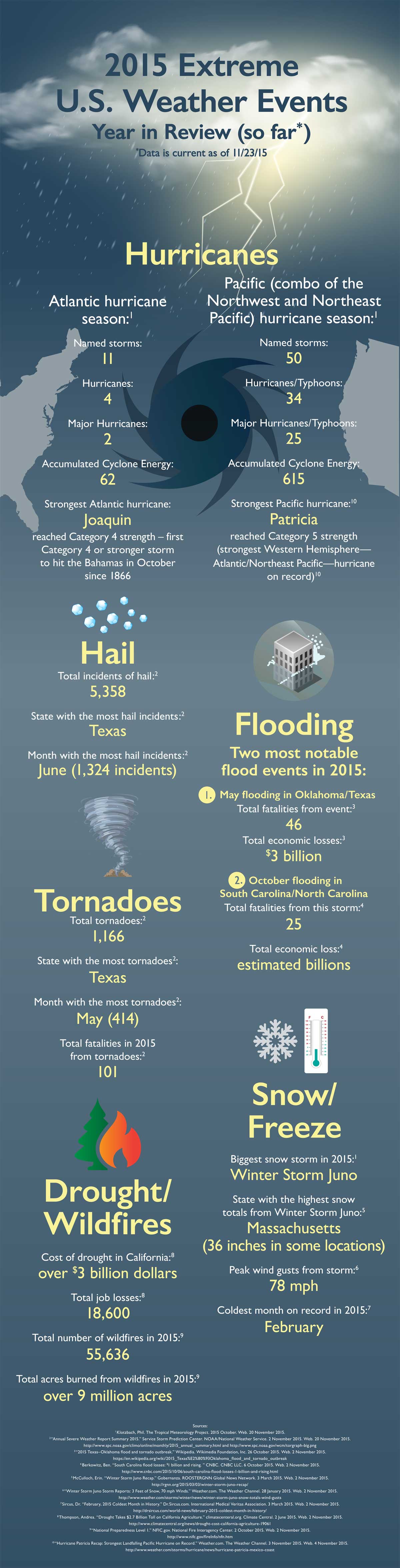

Turning specifically to property exposures, supply chain disruption was identified by 61% as the top risk, followed by flood (30%) and tornadoes (9%). The findings reflect a growing recognition of the potential exposures that longer and more complex supply chains introduce, the firm said.

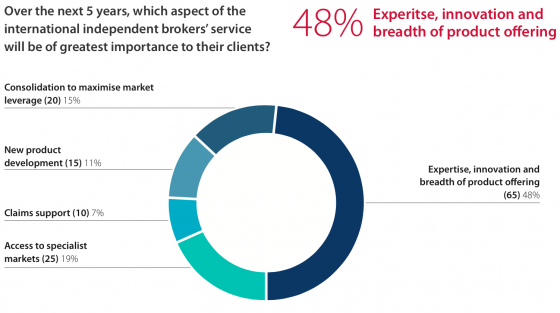

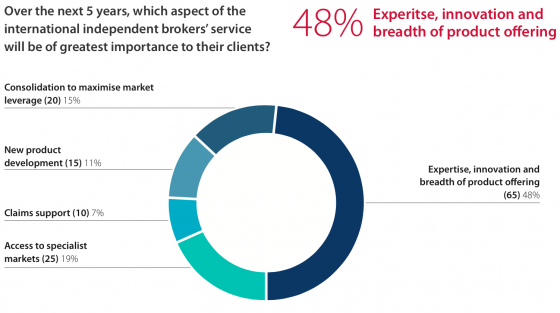

The brokerage also asked insurance professionals what they think clients are and will be most concerned about when evaluating a broker’s service, and in turn, what brokers will need to focus on to stay competitive. They predict: