The Ferguson wildfires have been spreading in Mariposa County, California on the western edge of Yosemite National Park for days, burning 27 square miles and taking the life of one firefighter.

The Ferguson wildfires have been spreading in Mariposa County, California on the western edge of Yosemite National Park for days, burning 27 square miles and taking the life of one firefighter.

The Mercury News reported that more than 1,400 firefighters have been on the scene trying to protect 100 nearby homes and businesses that are in the fire’s path as it moves south and east.

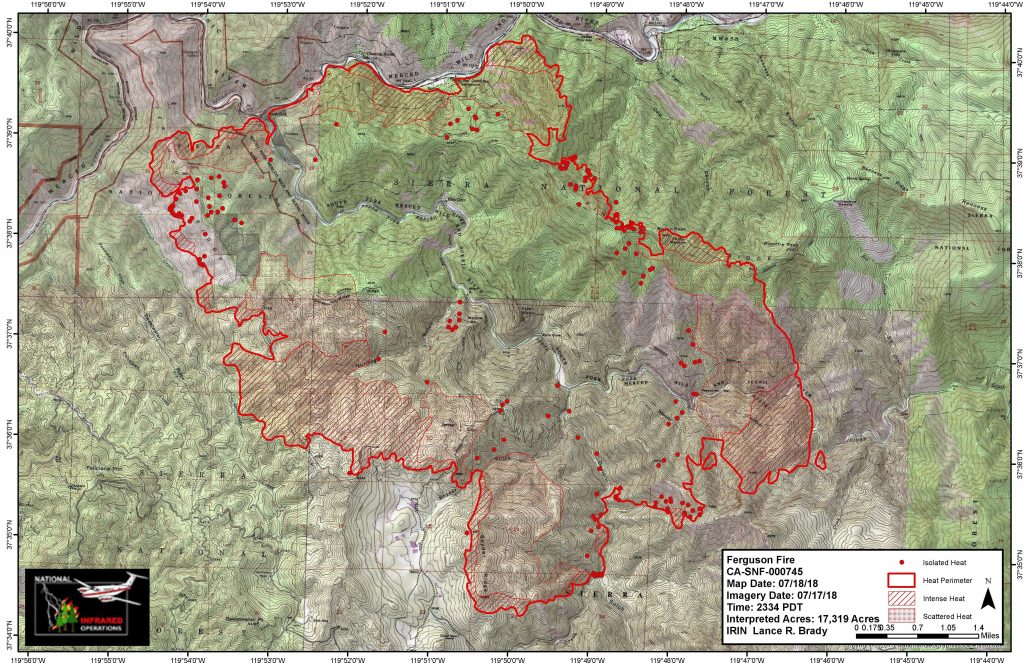

The fires began July 13 at about 8:30 p.m. and by July 15 had nearly doubled to 9,300 acres. On Wednesday it was at 17,319 acres and 5% contained. And while authorities have not declared an official cause, Colin Gannon, senior data analyst at Four Twenty Seven, which studies the economic risk of climate change, said weather and environmental conditions are certainly contributing factors.

“In [this case], three factors—persistent wind, low humidity, and high availability of fuel sources—aligned just right for rapid fire growth. Weather conditions in the days leading up to the fire were extremely hot and dry, with temperatures approaching 100°F, and strong winds pushed the fire into the hills and valleys, allowing the it to spread quickly,” Gannon said. “Compounding this issue is the widespread presence of dry needles and dead trees, which are a highly combustible fuel source. To make matters worse, the location of the fire in steep and rugged terrain has made access difficult for those fighting the fire.”

On July 15, Pacific Gas & Electric Co. switched off power lines serving the area, affecting parts of Yosemite, El Portal and Foresta, in an effort to mitigate further fire risk.

The severity of the fires has not closed down Yosemite, which is nearly 1,200 square miles wide, but did force the closure of several miles of Highway 140 in Mariposa County west of El Portal, limiting some access to the park. The park’s website also advises visitors to “expect poor air quality and limited visibility due to the Ferguson Fire. Smoke may be heavy at times, and visitors should be prepared to limit any heavy outdoor activity during the periods of poor air quality.”

Weather is expected to remain hot and dry for the next seven days, with isolated thunderstorms possible over the Sierra Crest, which authorities are hoping could provide some relief.

According to the California Department of Forestry and Fire Protection, 3,213 fires burned 98,169 acres in the state between January 1 and July 15 of this year. That acreage is down more than 30,000 from this time last year. By September 2017, the Forest Service and Interior Department had spent more than $2 billion fighting fires in the United States for the year — making it the most expensive wildfire season on record.

The insurance industry has been reacting to the high activity, Gannon said, particularly regarding residential properties in risky areas.

“There have been incidents of private insurers dropping coverage for homeowners in high fire risk areas,” Gannon said. “It is difficult to say how pervasively this will occur when new science, and subsequently new understanding of fire risk, becomes available. As a result, state insurance, otherwise known as the California FAIR plan is stepping in to provide coverage for high risk areas.”

As Risk Management Monitor reported, the Insurance Institute for Business and Home Safety (IIBHS) recommends that organizations survey the materials and design features of their structures; as well as the types of plants used, their location and maintenance.

Companies also should determine their fire hazard severity zone (FHSZ) by evaluating the landscape, fire history in the area and terrain features such as slope of the land. Organizations can request the FHSZ rating from local building or fire officials in their area.

IIBHS notes three sources of wildfire ignition:

- Burning embers, or firebrands, generated by a wildfire and made worse in windy conditions.

- Direct flame contact from the wildfire.

- Radiant heat emanating from the fire.

May 18. The online event will feature 29 webinars tackling a variety of issues under the resiliency umbrella, including crisis leadership, workplace recovery and data breaches that will be hosted by BCI members and organizations such as Amazon and Google. Additionally, BCI will host three onsite launches for its organizational resilience manifesto in London, Toronto and Sydney.

May 18. The online event will feature 29 webinars tackling a variety of issues under the resiliency umbrella, including crisis leadership, workplace recovery and data breaches that will be hosted by BCI members and organizations such as Amazon and Google. Additionally, BCI will host three onsite launches for its organizational resilience manifesto in London, Toronto and Sydney.

Many of those who had returned home after the wildfires have been evacuated for mudslides. The

Many of those who had returned home after the wildfires have been evacuated for mudslides. The  Driving rain started at about 3:00 a.m. on Jan. 9. By Tuesday,

Driving rain started at about 3:00 a.m. on Jan. 9. By Tuesday,