Last month, the American Customer Satisfaction Index released its latest figures for 190 major brands across all industries. The finance and insurance industries got some good news: satisfaction increased across the sector in 2013. But a careful look at some of the “worst” companies in the survey reveals a trend that may call into question some traditional wisdom on one key risk: reputation.

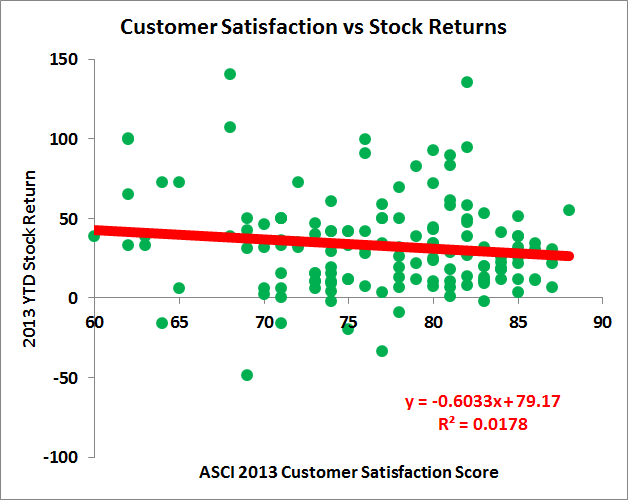

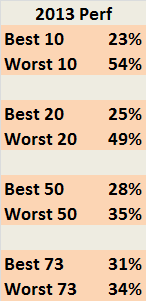

As Eric Chemi points out in Bloomberg Businessweek, a comparison between these satisfaction scores and 2013 stock returns – factoring in only publicly-traded companies with at least a full year of trading data – shows that customer service scores have no relevance to stock market returns. In fact, when Chemi added a regression line, he found that stock returns actually decreased as satisfaction scores went up.

The slope is minimal, so there is no statistical relationship between the variables, but the trend itself is curious. Clearly, other factors account for the market success of a publicly traded company, and reputation may impact a company’s bottom line off the NYSE floor. This chart does illustrate, however, that good guys do tend to finish last in even the broadest groupings.

So, if reputation doesn’t necessarily impact one major metric of a company’s success, is there a secondary market for being liked? Does reputation make or break other metrics, like net profits or market share? Given that many other studies seem to suggest that reputation does have a negative effect on stock prices, there is likely more at work here.

Similar Posts:

- Cyberbreach and Reputation Woes Hack Away at Bottom Line for 44% of Financial Firms

- Paula Deen and the Impact of Reputation Risks

- Corporate Reputation Drastically Impacts Talent Acquisition, Salary Costs

- Financial Services Firms Report Losing 27% of Revenue Due to Poor Reputation

- Putting Risk Management on the Front Line

Is reputation a risk at all. For me its more of an impact or consequence of how you behave. Most everything you do could potentially effect reputation. Currently in Ireland Charities are suffering acutely in fundraising because of concerns over inflated packages for senior managers in that sector. Customer satisfaction is undoubtedly related to Reputation but it is only one element. Look at BP and Gulf Water debacle and share price. Reputation is earned and can be lost quite quickly. The survey is probably looking at slower burn issues with customers.

First of all, the R2 is almost zero. So any inferences on the data are not meaningful.

Second, only one year is too short a time horizon. I suspect 2013 was a year when more risky stocks played catch up on less risky stocks.

Third, the blog queries whether reputation impacts the bottom line. Bottom line is profit, not stock return. I have little doubt that reputation impacts the profitability of companies, and also impacts the long-term survival of companies.

The really interesting question is if reputational risk has an impact on the beta of a stock – I suspect it does, but I have not done research on market studies, yet. This post is going to motivate me to do some digging – thanks!

Note to Javier: Your analysis is spot on, and yes, a superior reputation is associated with lower volatility.

As you imply, it is important not to confuse customer satisfaction and brand with reputation. Brand is a promise that sets customer expectations. If customers are not satisfied, then either the brand over-promised or the company’s execution under-delivered. Reputation is the measure of expectations driven by the awareness and measurable proof points of past experience and present circumstances.

There is a wonderful blog spot providing daily color on reputation here: http://consensiv.com/news-research/