(Rob Schmidt is business development manager at Rapid Refile, a document reprocessing company headquartered in Allentown, Pennsylvania.)

An often overlooked part of the massive losses suffered by businesses, academic institutions and other organizations as a result of fires, floods and other severe weather is the damage to critical records and documents. By not protecting and insuring these documents, organizations can face significant business continuity losses and compromised client services. There are several important steps that prudent risk managers can take to ensure that their critical documents are managed properly and protected as much as possible from a potentially damaging event.

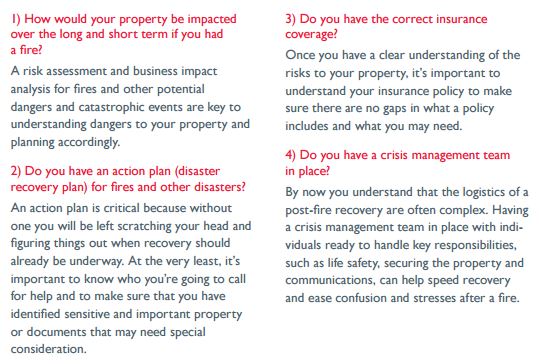

1. Understand Document Retention Requirements and Dispose of Unnecessary Documents

Document retention requirements are determined by city, state and federal regulations, and can vary by document type. A general rule of thumb is that financial records should be kept for seven years. Health records for children must be retained for 25 years. Deeds and loan documents must be kept permanently. Establishing a consistent base volume of stored records and documents can help determine the necessary level of insurance coverage. The longer the retention period, the greater the risk so purging those documents that are not necessary to retain can reduce the risk that damage will occur.

2. Assess Document Exposure

Determining the level of document exposure depends on the answers to several questions. First and foremost, what is the volume of critical documents? The more documents stored, the greater the cost to insure them. The more densely they are stored, the greater the localized risk.

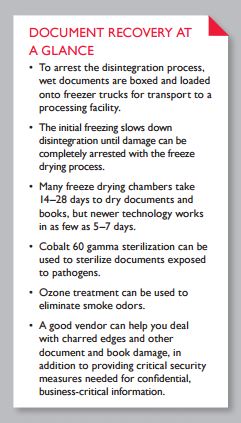

What type of recovery service is necessary? This answer will vary from business to business. If original documents are required, they will likely be returned after drying and cleaning with visible signs of damage, such as stains and bleeding of ink. This may be fine for archived files, but may cause problems for businesses such as medical facilities, law and accounting firms, and their clients. In another instance, a mortgage title company may likely want a drying, sterilization and cleaning option even when their documents are affected by Category III water (highly contaminated water such as sewage or floodwaters, also known as blackwater). Faced with the same dilemma, a medical facility is likely to prefer reproduction or imaging.

Is immediate access to documents important in the wake of a calamitous event? This will determine which of the two basic techniques for document drying is most appropriate. Vacuum freeze drying provides the best results for books and clay-coated paper. However, capacity is limited by the size of the drying chambers and backlogs can quickly develop if a document recovery specialist relies solely on this method. Desiccant drying effectively processes large quantities of documents, but causes wrinkling and requires trained technicians to avoid secondary damage to documents during the recovery process.

The information gleaned from the answers to these questions can be extremely useful in determining the potential cost of document and record restoration. However, there is no standard formula or computer model to generate cost estimates. Instead, the quantity of documents required for retention and the qualitative requirements of that retention are used to develop a hypothetical, industry-average cost estimate for a worst-case scenario loss.

It is important to remember, however, that any assessment of this kind cannot determine the cost of a total loss. Establishing the cost of drying 100 boxes of documents submerged in water for two days is doable. Understanding the cost of recovering those 100 boxes after they have been burned to ash is not.

3. Ensure Adequate Insurance Coverage

The cost of insurance is typically determined by the cubic feet of stored documents and records to be covered. A range of 0 to ,000 per cubic foot can provide a general low-to-high estimate of coverage needed.

Depending on the potential needs within that range, the type of coverage is another critical consideration.

Many insurance policies will specifically exclude coverage for documents under the contents verbiage of the policy. Instead, insurers want customers to address specific coverage of documents under the valuable papers portion of the policy. Valuable papers coverage is often described in the policy as the time to research, verify, and recreate files or information that have been damaged in a loss. Valuable paper coverage is broad and often will address the issue of document reproduction or imaging.

Valuable papers coverage is a reasonable “extension of coverage” on insurance policies, with coverage amounts ranging from $25,000 for standard coverage to several million dollars for specialty classes of businesses. Standard limitations may be adequate for small losses, but most likely will not be adequate to cover a major loss that would require the treatment of large numbers of documents. Ironically, the rule of thumb in the document restoration business is that the average client is under-insured.

Often, the key variable is how the adjuster will interpret the policy. Some adjusters will allow drying and cleaning documents to fall under business personal property coverage because the documents are tools used for conducting business.

This enables the original documents to be dried and/or cleaned and returned to use. The argument is documents such as medical charts are not just valuable papers or papers per se. The information on them is organized, regulated in how it can be amended or altered, and the charts must be bound in specific manner.

An important element of adequate insurance coverage is the quality of the claims handling process, which can be defined as the immediate response to the loss.

Specific wording to this effect in the insurance policy will help, as will periodic meetings among the insured customer, insurance professional and document restoration firm over the course of the policy period.

4. Preselect the Right Document Recovery Firm

There are only a handful of qualified document recovery firms in the United States. Preselecting one of them is not a process that should be taken lightly. Risk managers, who are serious about defining their exposure, should conduct in-person interviews with key document specialists — as opposed to area representatives or sales people — from the firms they are considering.

There is no standard pricing in the document recovery industry.

Basic services are typically measured by the cubic foot. However, one firm may charge $40 per cubic foot for drying and $35 per cubic foot for labor, handling and packaging, while another will charge an all-inclusive $72 per cubic foot for these services.

There are a number of differentiators among these firms in addition to price. Do they have the capability to handle a document restoration project on-site if necessary? What security measures do they employ — both on-site and in their plant? How quickly can they respond to a loss and provide a complete quote for the work? What is their backlog? Can they provide access to documents during the recovery process? Do they do the work in-house, which is preferable to ensure a timely response and open lines of communications between client and document recovery firm, or do they subcontract to another vendor? Do they itemize invoices, including all services and supplies? Are they appropriately insured, including sufficient pollution coverage?

Lastly, there are a number of external signals about a document recovery firm’s qualifications. Firms that are preferred vendors with well-known national insurance carriers have qualified on the basis of security, financial stability, quality control and accountability. Letters of recommendation from previous clients is also a good indicator of past performance.

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.