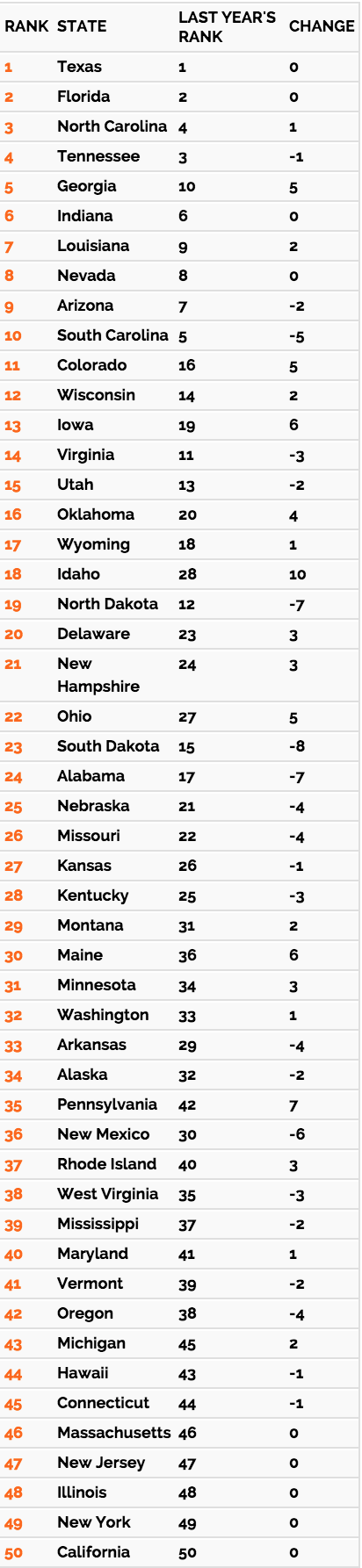

For CEOs, who naturally favor “pro-growth,” low-tax states, southern states present an undeniable bastion for business, according to Chief Executive magazine’s 2015 “Best and Worst States for Business” survey.

In this year’s survey, Texas remained the best state for business for the 11th year in row, followed by Florida, North Carolina, Tennessee and Georgia. Since the recession began in December 2007, 1.2 million net jobs have been created in Texas, while 700,000 net jobs were created in the other 49 states combined, the magazine reported. This job creation contributed toward unemployment rates 1% lower than the national average, an advantage rounded out by extremely favorable taxation and regulation, strong workforce quality, and very good marks for living environment.

Despite notably low unemployment, two of the greatest hubs for business drew particularly unfavorable marks from CEOs: California ranked last in the survey, preceded by New York. Illinois, New Jersey and Massachusetts completed the bottom five. CEOs gave these states the lowest ratings because of their high tax rates and regulatory environments. One CEO told the magazine, “The good states ask what they can do for you; the bad states ask what they can get from you.”

Compared to the 2014 rankings, Idaho has made the largest improvement, rising 10 spots to number 18, primarily due to high growth rates in GDP, while South Dakota dropped eight places, “even though quality-of-life attractions enhance the state’s low-tax bona fides,” the magazine reported.

Check out the full rankings below: