The active 2020 hurricane season has produced so many named storms that scientists ran out of traditional names and have moved to the Greek alphabet for the first time since 2005. Most recently, Hurricane Sally struck the Gulf Coast, making landfall in Alabama with winds above 100 miles per hour, causing widespread destruction, and leaving hundreds of thousands of residents and businesses without power. Ensuring that your business’ insurance program is ready to deal with such perils will prove critical to maximizing insurance recovery for business interruption and property damage claims. Below are critical steps policyholders can take now to ensure that insurance available if and when it is needed.

Locate a Copy of Your Policy

Having your policy on hand prior to a loss will help start your claim as soon as possible, as it may be more difficult to contact your insurer or broker following a storm, when thousands of claims are taking place simultaneously. Your policy will also provide important information regarding how to get in touch with your insurer following a loss.

In addition to windstorm and flood coverage, commercial policyholders should ensure that they have the following specific coverages in place before a storm hits:

- Physical Loss or Damage to Insured Property: This is the basic coverage afforded under almost all commercial property policies. Policies generally cover the cost to repair, replace or rebuild property that suffers physical loss or damage. Covered premises are usually listed or scheduled in the policy and may include not only buildings, but also equipment and business personal property such as furniture, machinery, and stock. Although typically a lesser concern, many policies do not include coverage or limit coverage for outdoor landscaping and paved surfaces like parking lots.

- Debris Removal: This covers costs incurred when removing debris from covered property damaged by an insured peril such as a windstorm. The maximum policy benefit for this coverage is usually expressed as a percentage of the total loss.

- Expenses Incurred to Mitigate Loss or Damage: Property policies often cover expenses incurred to prevent or minimize loss or, where some loss has already occurred, to mitigate additional loss. In fact, many policies say the policyholder must take steps to safeguard the property and prevent further damage. Failure to do so could jeopardize coverage.

- Extra Expense Coverage: Extra expense coverage is intended to indemnify the policyholder for expenses that are above and beyond the business’s normal operating expense that are incurred to continue operating the business after damage has occurred. Examples may include the cost of a generator when electricity is lost, increased costs to secure new materials or replacement inventory or costs to operate at a temporary location.

- Business Interruption Coverage: Business interruption coverage is designed to cover lost business income resulting from the total or partial suspension of operations due to covered property damage. Typically, this coverage does not apply until after a designated “waiting period”—usually defined in hours—which operates as a sort of “deductible.”

- Orders of Civil Authority: Coverage may also be available when business income is lost as a result of government directives, issued because of property damage to other property, which prevent or restrict access to the insured property. These can include evacuation orders or curfews. These losses may be recoverable even if the company’s own property has not been damaged.

- Ingress/Egress Coverage: Similarly, many policies cover losses when entry to or exit from a covered property is prevented or hindered by damage of the type insured under the policy, such as downed trees covering a road or a broken bridge. Importantly, the damage need not be to insured property so long as the damage prevents ingress to or egress from an insured location.

- Service and Utility Interruptions: Some policies may also provide coverage for business interruption losses and extra expense caused by power, water, and telecom outages if those outages are the result of an insured event. This coverage is typically sublimited.

- Contingent Business Interruption Coverage (CBI): Contingent business interruption insurance and contingent extra expense coverages provide reimbursement to the policyholder for lost income and extra expense resulting from property damage to a separate, non-insured property, often in the policyholder’s supply chain. The third party could be a supplier of critical materials or components; a transporter of goods, materials or resources; or a wholesaler, retailer, or customer who purchases or consumes the insured’s goods on a regular basis. Some policies may offer this coverage for “leader properties” or “attraction properties” within a specific mile radius of the insured property.

- Extended Period of Indemnity: Policies may also provide for an extended period of indemnity, thus extending the time of covered business interruption losses from the time the property is repaired for several additional months. This coverage is designed to ensure coverage for any “ramp up” period the policyholder experiences to ensure coverage until business returns to normal.

- Spoilage Coverage: Commercial property policies for food-service and hospitality industry insureds may also contain endorsements providing coverage for loss of perishable stock at the premises of the policyholder.

Have an Insurance Response Team in Place Before the Storm

Commercial policyholders should know who they are going to contact for emergency repairs and services. Having an emergency action plan in place, with cell phone contact numbers, will minimize downtime and maximize recovery efforts after the storm. Document or photograph your pre-loss inventory and other insured assets to provide to your insurer when adjusting your claim. They may not be able to reach your property immediately following the storm.

Following the storm, your team should set up a general ledger to capture all storm-related costs, expenses, and time, including costs incurred to mitigate storm losses. Designate a point person to liaise with the insurer’s adjuster and to submit storm-related invoices, quotes and contracts. Document everything, including physical damage, evacuation orders, curfews, power outages, supply chain disruptions, and extra costs.

Present Your Claim As Soon As Practicable

Insurance companies require prompt notice of a loss. Once the claim is submitted, check your policy regarding the submission of a proof of loss, as is often required. These documents have deadlines, some of which are triggered without any request from the insurer. Request an extension if you need one to ensure timely submission. Use photographs, videos, or other documentation to substantiate your claim, and keep a log of all communications with your insurer and adjuster, including phone calls. An accurate timeline of communications will assist in any potential litigation regarding your claim.

In the event of a denial, delay, or recovery smaller than required to repair your business, experienced coverage counsel can help you analyze your policies, enforce your rights and hold your insurer to their contractual and statutory obligations.

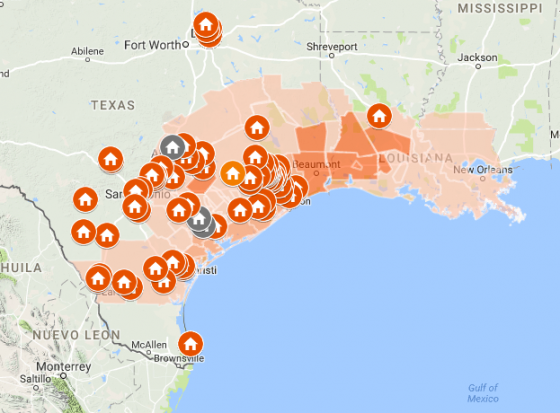

Hurricane Harvey, which made landfall in Texas on Friday night as a Category 4 hurricane, has so far caused at least five deaths and more than a dozen injuries. Now a tropical storm, Harvey has dumped more than 30 inches of rain on the Houston area, with another 15 to 20 inches anticipated by Friday.

Hurricane Harvey, which made landfall in Texas on Friday night as a Category 4 hurricane, has so far caused at least five deaths and more than a dozen injuries. Now a tropical storm, Harvey has dumped more than 30 inches of rain on the Houston area, with another 15 to 20 inches anticipated by Friday.