Experts now project damage figures could be in the billions of dollars as a result of last week’s Hurricane Laura, the category 4 storm that hit several Caribbean nations as well as Louisiana and Texas in the United States.

Laura was the strongest hurricane to hit Louisiana since 1856, but the damage may end up costing less than previous storms because it did not hit heavily populated cities. In 2005, Hurricane Katrina caused $160 billion in damages, while 2017’s Hurricane Harvey cost $125 billion.

Karen Clarke & Company estimated on August 28 that the damage will total almost $9 billion in the United States, and $200 million in the Caribbean, where it hit Antigua, Cuba, the Dominican Republic and Hispaniola.

CoreLogic put the damage in Louisiana at $8 billion to $12 billion, and estimated that the damage in Texas would total less than $500 million. Moody’s Analytics also provided a preliminary damage estimate of between $4 billion and $7 billion.

According to Louisiana news site The Advocate, State Farm, which has around 278,000 policies in Louisiana, said it had received more than 7,000 claims as of last week. The National Flood Service said Friday that FEMA had received nearly 100 claims for damage caused by Laura.

On Thursday, Louisiana officials announced that over 230,000 residents still do not have power, and 175,000 have water outages. As of September 3, 21 Louisiana residents have died related to the storm, with the Louisiana Department of Health reporting that at least 8 deaths were from carbon monoxide poisoning related to improper generator use.

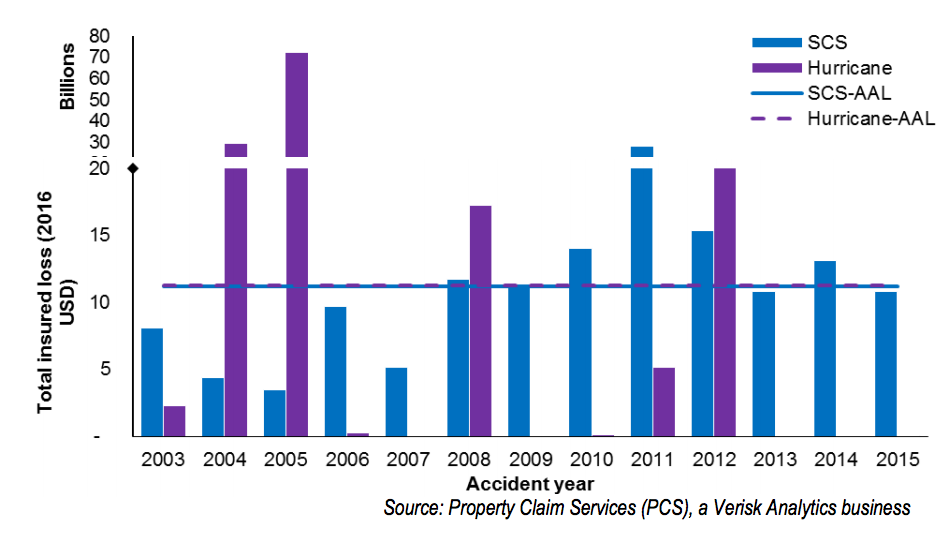

In a new report, Hurricane Season: More Than Just Wind and Water, the Insurance Information Institute said that losses from hurricanes have risen sharply over the past 16 years, growing quicker than inflation by almost 7%. Citing Aon director and meteorologist Dan Hartung, the III reported that “2017, 2018 and 2019 represent the largest back-to-back-to-back insured property loss years in U.S. history.”

The Institute blamed these rising costs on populations moving to more hurricane-prone areas like Florida and Texas, and building bigger, more expensive houses in those areas. When these houses—and the expensive property in them—are damaged, the insurance payouts are higher.

Additionally, hurricanes have brought significantly more water inland as climate change intensifies, the report noted. These factors have all caused more flooding and more insured property damage. The Institute said that rising hurricane losses, plus claims related to the COVID-19 pandemic, will likely translate into insurance rates increasing in the near future.