Despite the challenges of a slowed economy in an election year, a shifting risk landscape as a result of technological advances, and a slow to negative growth rate in some sectors, 2016 saw the total cost of risk (TCOR) decline for the third consecutive year, according to the 2017 RIMS Benchmark Survey.

Even in the face of such uncertainties, the TCOR per $1,000 of revenue continued to drop, ending at $10.07 in 2016. The main drivers were declines in all lines excluding fidelity, surety and crime costs, according to the report. TCOR is defined in the survey as the cost of insurance, plus the costs of the losses retained and the administrative costs of the risk management department.

The survey encompasses industry data from 759 organizations and contains policy-level information from 10 coverage groups, subdivided into 90 lines of business.

Uncertainty around policies in the new presidential administration will continue to dominate in 2017, as the nation’s trade policy, regulatory reform and tax system could see changes, RIMS reported. The new political regime is also expected to reduce regulatory oversight at the state, federal and international levels.

Key findings from this year’s RIMS Benchmark Survey include:

- Technological advances have caused a seismic shift in the risk landscape, creating new types of claims and forcing insurers to consider new products and solutions for customers.

- Insurers ended 2016 with average capital and surplus at the highest level in 10 years. However, excess capacity is undermining profitability, as seen by falling net income and return on average equity.

- The personal insurance space is in the midst of a consumer-centric revolution, offering customers new transaction platforms, better metrics and more flexible pricing and coverage options. Commercial insurance is expected to adopt a similar focus, transforming the way business is transacted.

- Predicted rate increases for cyber, E&O and workers compensation failed to materialize across the board. Projections for 2017 are more moderate, with property and most liability lines flat to down 10%.

- Emerging trends in the 2017 risk landscape include the tech revolution, security issues, natural catastrophes and political upheaval.

“The RIMS Benchmark Survey chronicles the evolution of corporate risk management costs over time. This year’s edition highlights how risk managers have effectively managed costs in a time of evolving risks and demands, enabling them to do more with less,” said Jim Blinn, executive vice president of client solutions at Advisen.

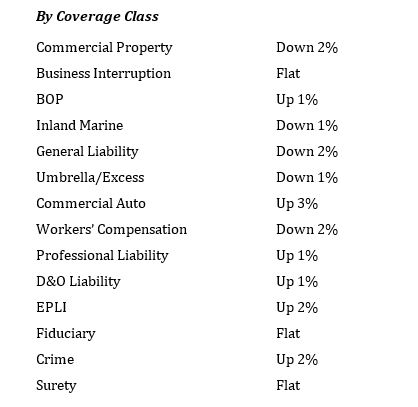

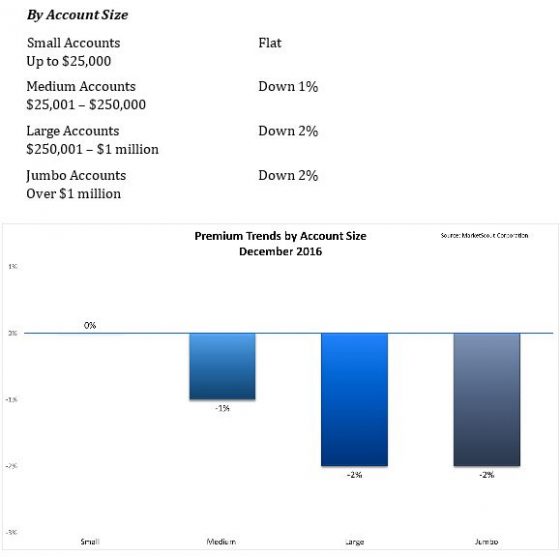

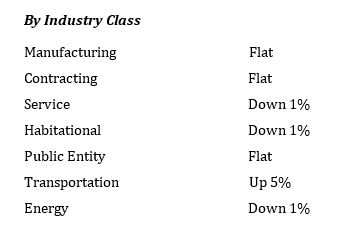

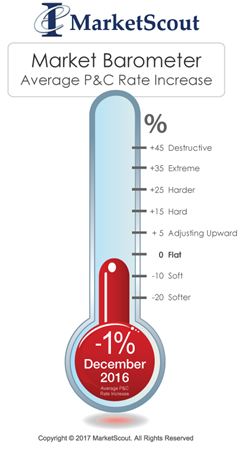

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.