Gloomy news: Companies across the world are now less prepared to deal with risks than they were two years ago. Even worse: Though companies have had nearly five years to respond to the global economic slowdown — which they cite as as the biggest risk to business — they are increasingly unable to confront the revenue problems it has created.

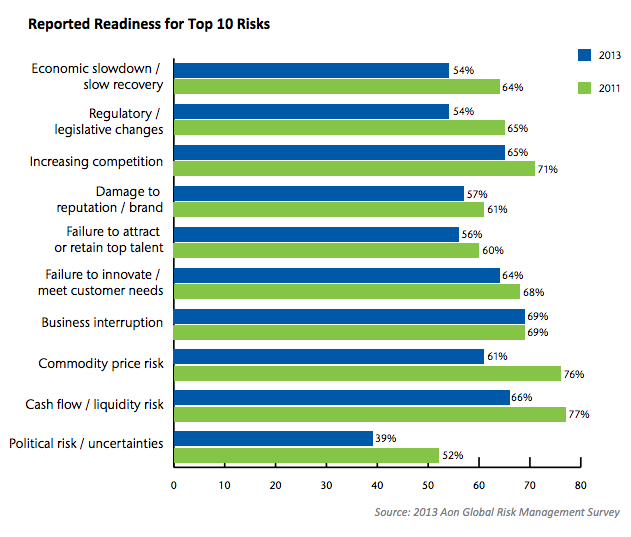

This is according to the 2013 Global Risk Management Survey released today at the RIMS 2013 Annual Conference & Exhibition by insurance broker Aon. To formulate its findings (displayed in the above chart), Aon compiled the “risk readiness” scores from companies’ responses to its survey and compared them to the results of its 2011 report.

“Risk readiness means a company has a comprehensive plan in place to address risks or has undertaken a formal review of those risks,” states the report. “In comparison with that of 2011, overall readiness for the top 10 risks has dropped by 7% to 59%. In fact, of the top 10 risks, all but business interruption has registered a decrease in overall readiness. Given the attention and scrutiny that risk management practices have received from stakeholders since the financial crisis, this is a disturbing trend and a bit surprising.”

As noted, companies still don’t know how to navigate the economic slowdown.

Aon offers some advice: “Since concerns over the world’s economy will not go away soon, organizations need to embrace it for the long-term and from a global perspective. We are no longer sitting on an island by ourselves. What happens on the other side of the world can have a direct impact on every organization, whether it has international operations or not.”

It isn’t just the international exposures that threaten revenue, however.

In another startling trend, companies are increasingly losing money due to regulatory and legislative changes. A staggering 54% of companies reported income loss (in the last 12 months) due to regulatory and legislative changes — a huge jump from 22% in 2011.

In addition to surveying companies and breaking down how they are responding to individual risks, Aon also analyzed how businesses are using risk management while creating strategy.

The short answer: They are not.

Only 22% of respondents consider “improved business strategy” to be one of the primary benefits of investing in risk management. While there has never been a time when risk management was heavily used to create strategy, this is actually a 1% dip from the 2011 report, in which 23% listed improved business strategy as a primary benefit.

Javier Gimeno, a professor of strategy at INSEAD, a business school in France and contributor to the report, highlighted the concern these findings raise. He notes that many of the top risks cited by companies are strategic in nature. And to deal with these types of threats, companies must re-think their strategy-formulating process. It must incorporate risk management.

“The practice in many companies is still sequential: strategy development comes first…and risk management takes strategy as a given and manages the ensuing risks,” he wrote. “That may lead to strategies that are not sufficiently flexible or adaptive. When strategic risk management is embedded as an integral part of the strategy process, the strategies can become more robust to uncertainty, and more flexible and exploratory.”

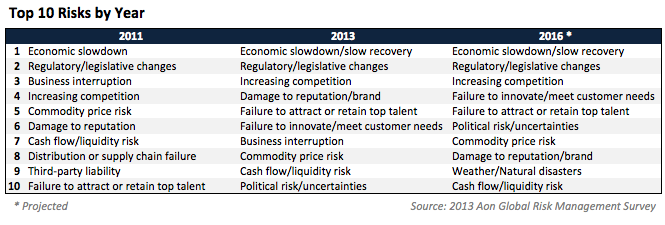

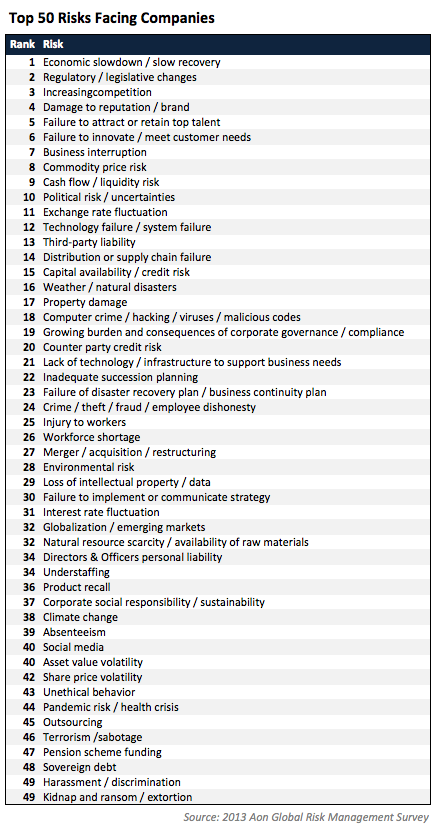

He concludes with some advice for companies that want to be better prepared for the 50 top risks (see chart below).

“Developing capabilities for strategic risk management by top management teams and boards should be an important priority in these uncertain times.”