People are living and working longer today than in the agricultural and industrial ages. The growth in the number and percentage of individuals over 60 and 80 years of age is already having a global impact.

People are living and working longer today than in the agricultural and industrial ages. The growth in the number and percentage of individuals over 60 and 80 years of age is already having a global impact.

From 1980 to 2017, the number of individuals over the age of 60 doubled to roughly 900 million. This segment of the world’s population will double again by 2050 to nearly 2 billion, according to the 2017 World Population Prospects report by the Department of Economic and Social Affairs of the United Nations Secretariat.

Risk professionals can prepare their organizations for the coming changes and opportunities of an older workforce with the following strategies:

- Customize a workplace safety program. Organizations can utilize various levels and different methods of training to improve safety awareness.

buy ocuflox online rxbio.com/images/milestones/jpg/ocuflox.html no prescription pharmacy

These include new hire training, annual mandatory compliance refreshers, on-the-job training, shadowing and formal mentoring programs, educational programs, and certifications. Training can focus on areas such as safety awareness, new technology, ergonomics and workstation setup, life skills, and other soft knowledge. This will also help with safety in general among the entire staff.

- Update the education and onboarding process. An important consideration is how different generations of employees learn, so specific training methods tailored to each generational group can be offered. Where online training modules may work for younger employees, older employees may prefer on-the-job or in-person training. It is up to each company to best identify the methods for training its workforce so the content of the training is effectively delivered and understood by its intended audience.

- Review training styles. In addition to receiving ongoing training, older employees may feel more engaged if they are asked to teach newer or less experienced employees. One area often overlooked is training for managers who may have older employees under their supervision. Much has been written about training and approaching millennials, however, the reverse is an emerging risk. Companies should begin focusing efforts on how to relate to and the best way to supervise older workers. This is an area of opportunity to enhance a company’s culture and develop the employee-employer relationship.

- Know a role’s physical demands. Employers need to ensure they have a good understanding of the actual physical demands of each job position in addition to the physical limitations of individual employees.

buy cymbalta online rxbio.com/images/milestones/jpg/cymbalta.html no prescription pharmacy

Post-offer and pre-employment functional capacity exams are recommended for all age groups in industrial and manufacturing sectors. Job rotation is an important safety tool, and can be used for all age groups in an effort to break up the monotonous nature of the work, avoid fatigue, and ultimately develop a well-rounded staff that can cover gaps as needed.

- Consider the intersection of technology, comfort and well-being. There are many low- and no-cost ideas that can make the workload more manageable for older employees. For example, in its Dingolfing, Germany plant, BMW hires older workers on an auto assembly line with accommodations for their age such as larger computer screens, special shoes, and chairs for some operations. And Microsoft offers an online Guide for Individuals with Age-Related Impairments, showing older workers how to create slower-moving pointers or magnified screen displays by adjusting their computer’s settings. Standard workstations can be improved with ergonomics in mind. Features like built-in back support in office chairs, standing desks, lighting created to minimize shadows and dark zones, and desks that are easily adjustable all contribute to employees’ comfort and minimize discomfort. On-site clinics save time and are geared toward prevention as well as early disease detection. Investing in the health of all employees through wellness programs is a timeless and ageless benefit and will contribute to productivity and reduce costs.

buy cenforce online rxbio.com/images/milestones/jpg/cenforce.html no prescription pharmacy

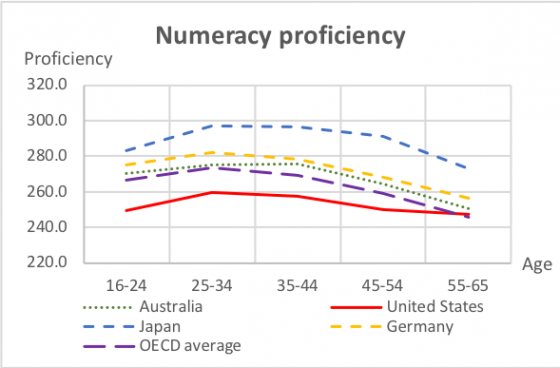

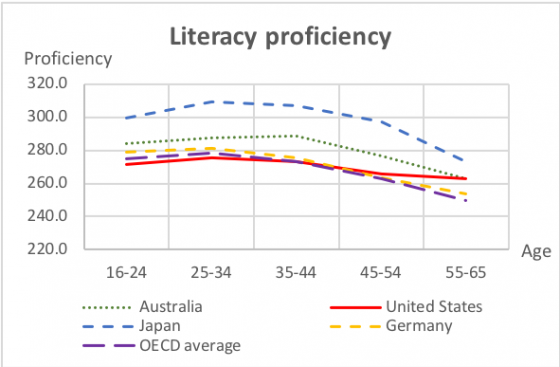

- Promote an age-diverse business culture by recognizing and appreciating the skills/values of older workers. There are common misunderstanding and stereotypes with older employees that they are less efficient than their younger co-workers. However, from the Organisation for Economic Co-operation (OECD) in 2016 that the working proficiency (in both literacy and numeracy) of older employees is actually not significantly lower than their younger peers. In countries like the U.S., the proficiency of older workers is even at the same level as younger employees (see below charts).

A follow-up study in 2018 by OECD indicated that older employees are more likely to involve in more complex tasks, such as supervise colleagues, have higher task discretion, use planning skills and influence others, which makes them as valuable assets as their younger co-workers. So it is important to promote an age-diverse business culture to appreciate the skills and value of older workers.

A follow-up study in 2018 by OECD indicated that older employees are more likely to involve in more complex tasks, such as supervise colleagues, have higher task discretion, use planning skills and influence others, which makes them as valuable assets as their younger co-workers. So it is important to promote an age-diverse business culture to appreciate the skills and value of older workers.

- Improve training against discrimination and negative attitudes to older workers on hiring, termination, compensation, and promotion. As risk management professionals, it is important to remind your organizations to review and improve the policy against discrimination and negative attitudes to older employees, in order to mitigate the potential legal risk. A 2013 AARP study indicated that “64% of U.S. workers have either experienced or observed age discrimination.” Given this background, in 2016, EEOC received 20,857 charges of age discrimination, which counted for more than 20% of all discrimination charges received by EEOC.

As the global working population continue to grow older, corporations around the world could expect to see more age discrimination litigations to come. Risk managers can play an important role by taking initiatives to help their organizations against discrimination and negative attitudes to older employees.

Several members of the RIMS International Council contributed to this article.