MUMBAI—”Why are we here?” asked RIMS CEO Mary Roth, welcoming over 100 risk professionals to the recent RIMS Risk Forum India 2019 in Mumbai. “If you look around this room, I think we all share very similar reasons. Risks are changing. Today’s risks seem more complex, and they hit our organizations faster. Think about our climate: heat waves, droughts, and other extreme weather events we’re experiencing. Data: it’s abundant and rich. Technology: it’s evolving overnight, and so are the related risks and opportunities.

”

She added, “Expectations have never been greater for our organizations to quickly adapt and implement emerging technologies, address cyber exposures, brace for political change, and uphold ethical and social standards.”

The day’s sessions delved into critical issues like emerging technology, fraud, regulation, and building a risk culture, drawing upon expertise from panelists ranging from the C-suite to regulators themselves. Another key theme was clear to all in attendance: the rapidly shifting role of risk management in organizations across India, and the opportunities that new risks are presenting here.

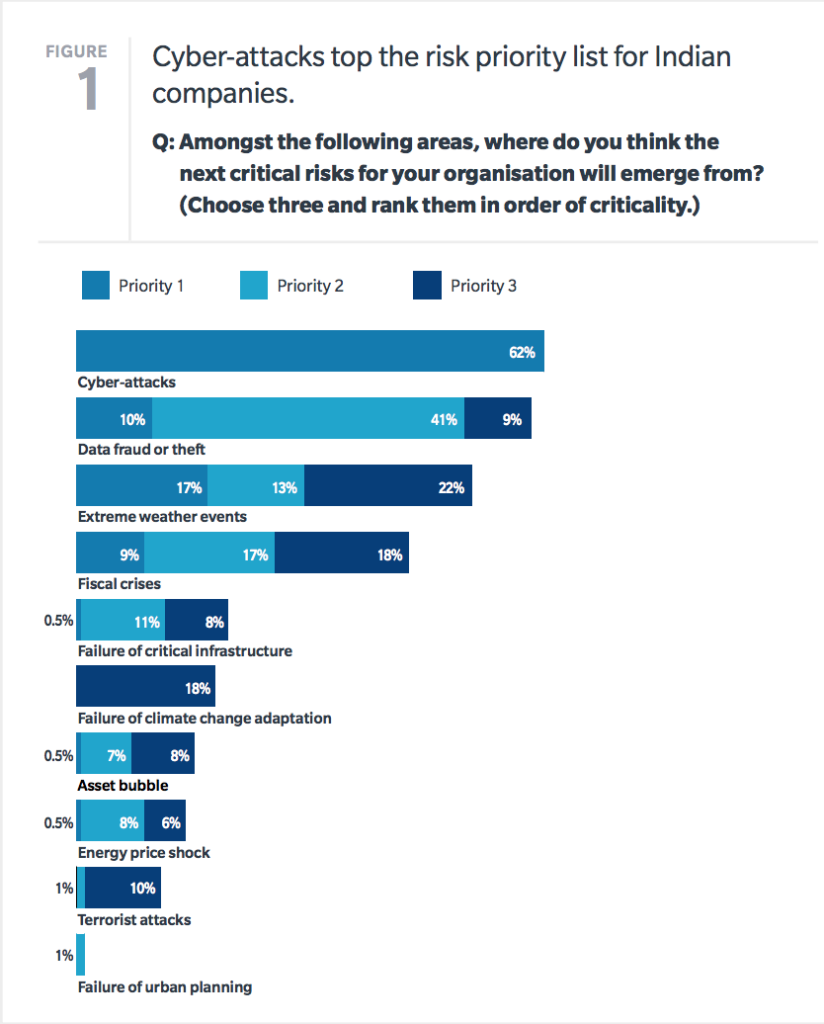

According to the new Marsh and RIMS “Excellence in Risk Management” report State of Risk Management in India 2019, which was unveiled at the forum, many of these issues dominate the risk landscape for organizations operating in the country. Indeed, cyberattacks, extreme weather, and data fraud or theft top the agenda for risk professionals in India this year.

According to the new Marsh and RIMS “Excellence in Risk Management” report State of Risk Management in India 2019, which was unveiled at the forum, many of these issues dominate the risk landscape for organizations operating in the country. Indeed, cyberattacks, extreme weather, and data fraud or theft top the agenda for risk professionals in India this year.

Across 23 industries, a vast majority of senior risk professionals cited cyberrisk as their top concern, with 62% agreeing cyber poses the greatest risk to their organization—nearly four times the number who prioritized the runner up, weather events.

“India, like other countries, has been susceptible to malicious cyber attacks and there is growing awareness among corporates of the need to ensure they have appropriate cybersecurity controls,” said Sanjay Kedia, Country Head and CEO, Marsh India. “Firms need to keep up with the evolution of cyber threats if they are to capitalize on technology-based opportunities.

This will require organizations to make additional investment to ensure they have adequate protection.

”

As the profession matures and expands in the region, risk professionals looking to earn a seat at the table are focusing on their potential to serve as a key strategic partner driving these investments.

“Global business leaders who have engrained risk management into the fabric of the organization’s strategic planning processes have become better equipped to make informed, proactive, and rewarding decisions,” said RIMS CEO Mary Roth.

“India’s risk management community continues to demonstrate its strength, as well as its passion for developing advanced capabilities that support growth and innovation.”

To that end, these top issues are also covered in greater depth in a recent special issue of Risk Management curated specifically for risk professionals in India. Originally available exclusively for attendees of this year’s RIMS Risk Forum India, Risk Management Special Edition: India is now available for readers worldwide. Check it out today and, if you have any feedback, we would love your input to help inform future international coverage—email your thoughts to HTuttle@rims.org.

To that end, these top issues are also covered in greater depth in a recent special issue of Risk Management curated specifically for risk professionals in India. Originally available exclusively for attendees of this year’s RIMS Risk Forum India, Risk Management Special Edition: India is now available for readers worldwide. Check it out today and, if you have any feedback, we would love your input to help inform future international coverage—email your thoughts to HTuttle@rims.org.