Over at the Clear Risk Blog (which you should be reading regularly), Craig Rowe posted some great stuff yesterday on how risk managers can be better insurance consumers. Some of this should be basic to many of you oh-so-savvy industry veterans, but even if it’s just a refresher, Rowe puts an insightful, quick-to-read spin on some of the fundamentals.

Take this piece of advice, for instance:

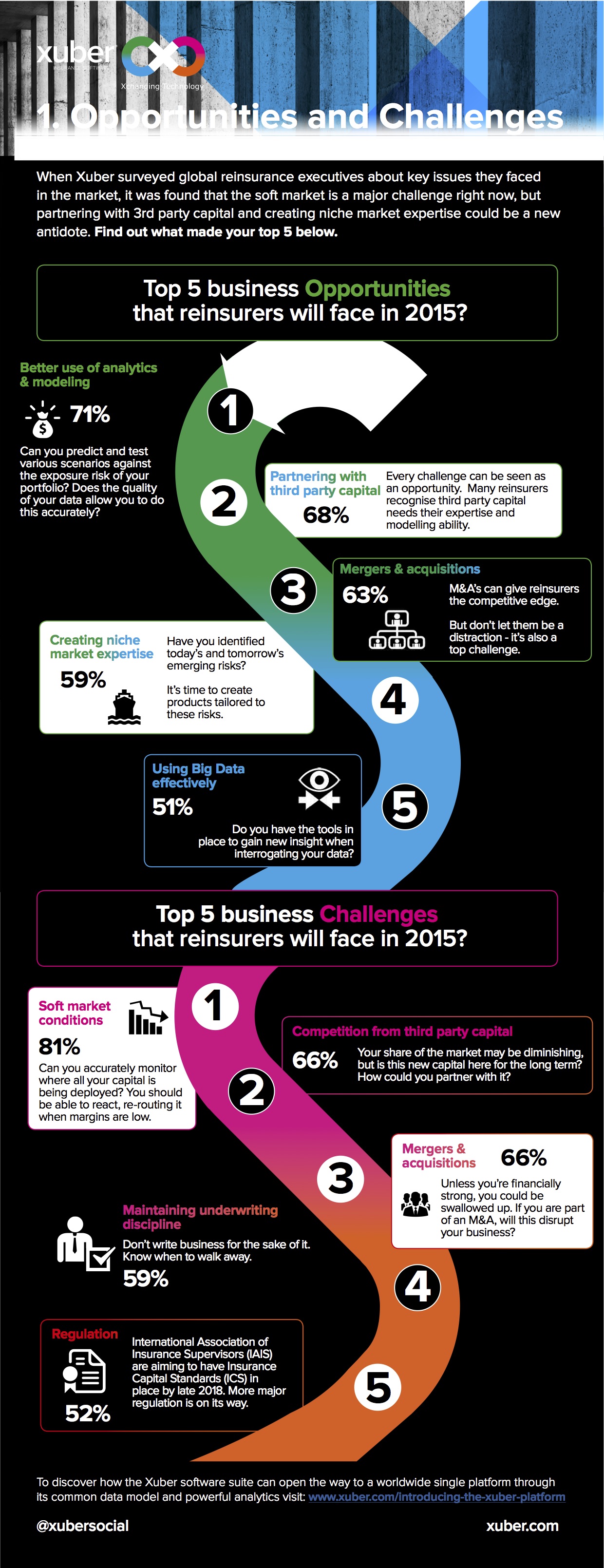

First and foremost, budget for the market cycle. The insurance market is cyclical with wide swings between the peaks and valleys. Budget at the high end of the cycle and keep your budget consistent.

online pharmacy

avodart with best prices today in the USA

When prices start easing, remember that an upswing is on the horizon.

It’s a simple concept and something that all risk professionals need to do. But more importantly, they need to be able to convince those above them with final budgetary authority that, even though the department is saving money on policy costs this year, they can’t count on that being a permanent savings. It most certainly will not last.

As they say, you may be getting coverage on the cheap today, but, soon enough, you’ll be overpaying for it again. For those at the top, this shouldn’t really be a problem. Ultimately, the organization is paying for the long-term peace of mind that the policy provides, so it’s important that leadership understands the cyclical nature of the upfront costs and doesn’t get used to today’s comfy prices.

online pharmacy

antabuse with best prices today in the USA

Here’s another recommendation:

Sell your company to the insurance market. Insurance companies compare you with all the other companies in the same industry. Make sure that your insurer is aware of all the things you do that make you a better risk. The things you do in your organization to reduce down time, improve quality and to prevent losses make you a better risk than companies that don’t do these things. Insurance companies want to know that you care more about risk than they do.

I know what you’re thinking: Easier said than done, buddy.

Risk managers have been advocating for the market to recognize differentiation for longer than I’ve been in the industry. They want companies to stop treating them as numerical calculations within some pre-defined risk cluster and start seeing them as an individual company with individual risks. Unfortunately, even the most forward-thinking companies in regards to risk mitigation still rarely see significant premium savings — at least not as much they deserve for taking progressive steps to limit their exposures. There has been plenty of progress, sure. But in this regard, the road ahead is still longer than the path already traveled.

But that doesn’t mean you should stop pushing your loss control programs ahead.

It just means you get to keep complaining about policy costs.

online pharmacy

addyi with best prices today in the USA

And, honestly, isn’t that really risk managers’ favorite pastime anyway?

Be sure to head over to The Clear Risk Blog to find five other interesting insights on how to be a better insurance buyer.

Buying insurance aint easy, but you’ll be in good shape if you remember the basics. We’re not talking about a truly difficult purchasing decision like choosing which video game you want.

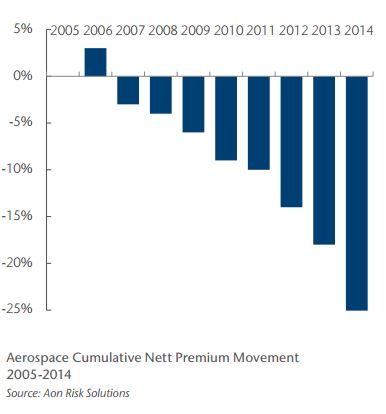

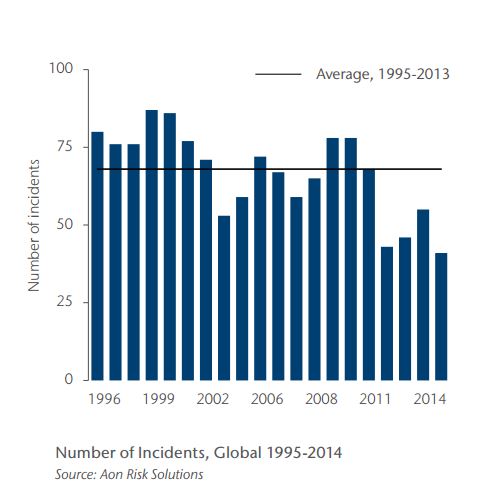

Favorable loss records and low claims in the aerospace industry has led to steadily falling premiums of about 5% for the past eight years and jumping to 8% in 2014, according a report by Aon Risk Solutions.

Favorable loss records and low claims in the aerospace industry has led to steadily falling premiums of about 5% for the past eight years and jumping to 8% in 2014, according a report by Aon Risk Solutions.