At the end of April, global internet access monitor group NetBlocks reported that Venezuela’s state-run internet provider ABA CANTV was restricting the country’s access to various social media platforms amid continuing demonstrations and political turmoil. In May, NetBlocks reports this has continued, in addition to similar internet limitations in Benin and Sri Lanka. While increased global internet connectivity has led to international economic growth, it has also often led to increased government control over methods of communication and commerce, and government shutdowns pose a serious risk to businesses and economic activity in these countries.

Businesses face a variety of challenges and risks when operating abroad, but internet shutdowns and limitations may present a unique impediment, especially for companies that operate largely online and rely on consistent internet access. With more countries shutting down or limiting access more frequently, companies that conduct business in countries with regular interruptions may need to plan accordingly, or reevaluate whether their operations can accommodate these disruptions. Companies that have internet-dependent supply chains may be particularly susceptible and should ensure they have comprehensive mitigation strategies in place to avoid business interruptions.

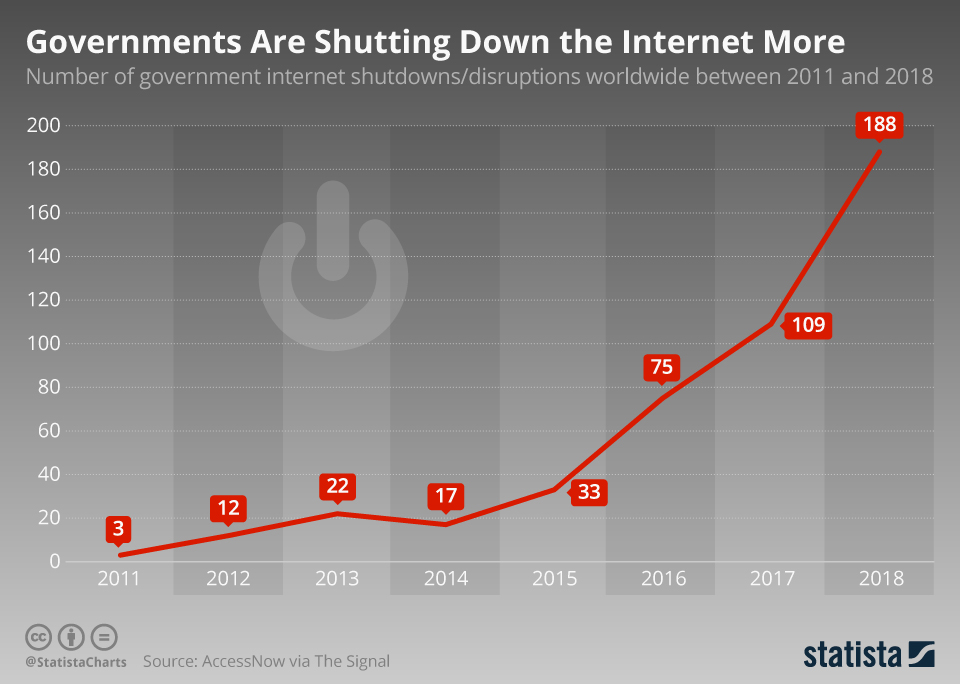

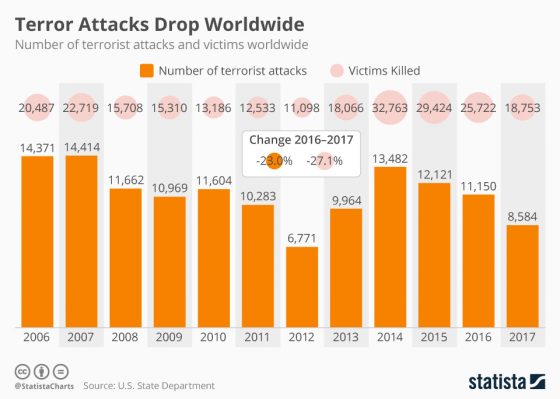

Many nations increasingly use internet and social media disruptions as a way to quell political dissent. Some countries have shut down social media after violent incidents, purportedly to curb people’s ability to incite further violence, such as in Sri Lanka after the Easter suicide bombing there. Ethiopia also limited internet access in 2017 after activists leaked copies of the national school exams online. Whatever a country’s motivation, the frequency of shutdowns worldwide is rising dramatically, according to Stastista, which notes a 6,000% increase between 2011 and 2018.

The Indian government routinely implements shutdowns in various parts of the country, and has in turn suffered serious economic consequences. The Indian Council for Research on International Economic Relations recently reported that, between 2012 and 2017, internet shutdowns in India climbed from 3 to 70 per year, and the shutdowns’ total duration rose from 9 hours in 2012 to 8,141 hours in 2017. According to the report, titled The Anatomy of an Internet Blackout, these disruptions cost the Indian economy approximately $3.04 billion in total. This includes approximately $2.37 billion from mobile internet loss and $678.4 from fixed line internet shutdown.

The Brookings Institution released a study in October 2016 examining 81 short-term shutdowns in 19 countries and their impact on GDP. Between July 1, 2015, and June 30, 2016, the study found that the economic consequences of internet shutdowns cost at least $2.4 billion in GDP globally. The report notes that this is a conservative figure and does not account for tax losses or drops in investor, business, and consumer confidence.

Deloitte also examined the issue in 2016, estimating that the economic consequences of a temporary shutdown “grow larger as the level of connectivity and GDP increase.” For highly connected countries, a temporary shutdown could cut 1.9% of daily GDP—an estimated $141 million per day. Medium-connectivity countries lose an estimated 1% ($20 million) of daily GDP and low-connectivity countries could lose an estimated 0.4% ($3 million) of daily GDP.

A study released in October by Strathmore University’s Center forIntellectual Property and Information Technology Law (CIPIT) showed that shutdowns can also severely impact countries’ shadow economies, often uncounted in formal studies like those from Brookings and Deloitte. According to the report, titled Intentional Internet Disruptions in Africa, unreported economic activity in 49 African countries made up an average of 37.65% of all economic activity. Because this activity is not counted in previous formal studies (like the Brookings study), CIPIT estimates that including these shadow economies increases the total cost of shutdowns by 19% to 29%.

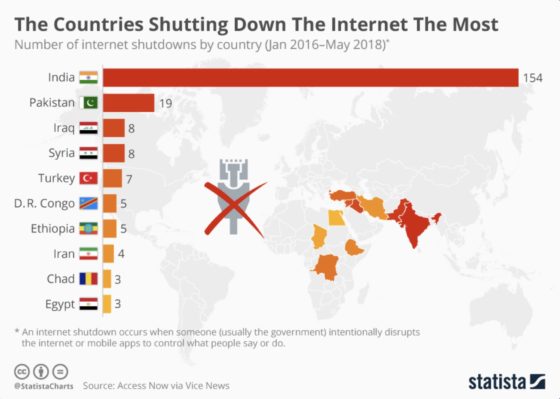

Another Statista study from August 2018 shows that certain countries are shutting down their internet more often than others, most notably India, Pakistan and Iraq. Risk managers should consider these figures and cost estimates when assessing their companies’ existing or potential operations in the countries noted below, or when looking at where to invest overseas.

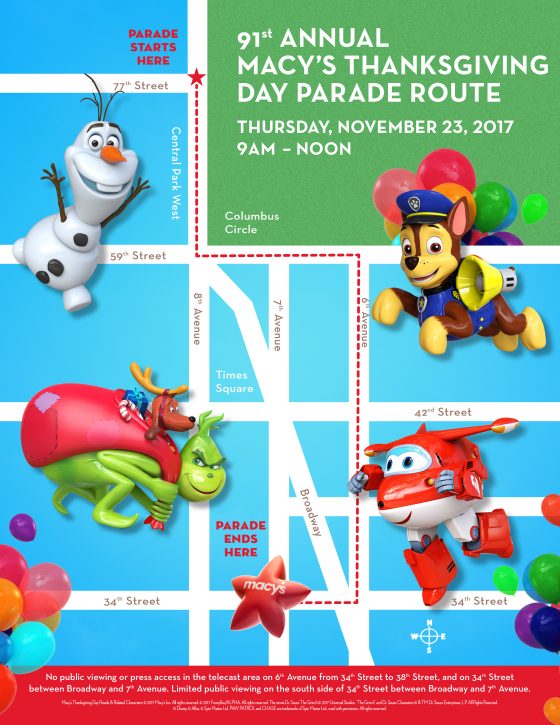

Theresa Morzello, the managing director for asset services for CBRE in New York City, has advised many companies who stay open or host events coinciding with parades and holidays. She said the first steps in mitigating disruption involve communicating with the event organizers and disseminating that information to tenants.

Theresa Morzello, the managing director for asset services for CBRE in New York City, has advised many companies who stay open or host events coinciding with parades and holidays. She said the first steps in mitigating disruption involve communicating with the event organizers and disseminating that information to tenants.