Last week, a severe thunderstorm unleashed massive hailstones in Alberta, Canada, damaging dozens of cars and unleashing potentially record-breaking hailstones the size of grapefruits. While the stones were notable, the storm was less of a rarity—indeed, hail is becoming increasingly common and increasingly costly as a natural catastrophe peril around the world. In 2020, Aon’s Global Catastrophe Recap identified hail damage in a severe thunderstorm as the driver of one of Canada’s costliest severe weather events on record. In 2021, insurers faced multiple billion-dollar loss events resulting from severe convective storms in the United States, with the greatest damage inflicted by hail that impacted the Plains, Midwest, Southeast and Northeast.

“Public perception often assumes that tornadoes drive the bulk of annual severe convective storm (SCS) damage costs,” said Steve Bowen, managing director and head of catastrophe insight on Aon’s Impact Forecasting team. “The reality is that large hail typically accounts for a majority of thunderstorm-related losses in North America during any given year.”

Further, North America is not alone in facing this peril, as hail also caused significant recent damage events in parts of Europe last year, struck Australia yesterday, and NOAA reports China, Russia, India and Northern Italy are all prone to damaging hailstorms.

As companies assess their natural disaster preparedness, there are some proactive measures that should be taken specifically for hail to leave organizations best positioned for any resulting insurance claims. Many commercial property policies contain provisions that any lawsuit against an insurer must be filed within one year following the “inception of loss,” otherwise it is barred. In other words, the “inception of loss” date starts the one-year clock ticking. The question then becomes, when exactly is that date? The Wisconsin Supreme Court hit this issue head-on in the case of Borgen v. Economy Preferred Ins. Co. In this 1993 opinion, the court determined that the phrase “inception of loss” in the context of hail damage essentially means “the date of the specific hail storm,” not “the date I discovered the hail damage.”

In 2018, the 5th Circuit Court of Appeals took things a step further in Certain Underwriters at Lloyd’s of London v. Lowen Valley View, L.L.C. In that case, a hotel filed a lawsuit against its insurer for refusing to cover hail-related roof damage under a commercial property insurance policy. The 5th Circuit agreed with the insurer’s argument that: 1) several hail storms had struck the vicinity of the hotel in the several years preceding the claim; 2) only one of those storms fell within the relevant coverage period; and 3) the record lacked reliable evidence permitting a jury to determine which of those storms, alone or in combination, damaged the hotel. The 5th Circuit further rejected the hotel’s engineering report, which asserted the subject storm was the “most likely” cause of the damage, deeming it insufficient.

Taken together, these decisions can blindside businesses that believe their insurance policies will automatically respond in the event of hail damage.

Let’s say you operate a business in Plano, Texas, and have a commercial property policy with a renewal date of January 1, 2022. You’ve noticed some recent leaks over the past week in your 8-year-old roof. Based on this discovery, you enlist a roofing contractor to investigate further. You learn that the roof needs to be replaced due to the existence of hail damage, so you submit a claim to your insurance carrier. Now, consider Plano has had at least 11 significant hail strikes since your roof was installed, according to StormerSite:

Storm Date Min. Hail Size Range (Max)

11/10/2021 1.00”

4/23/2021 1.00” (up to 2.00”)

5/18/2019 1.00”

3/24/2019 1.25” (up to 1.75”)

6/6/2018 1.00”

4/6/2018 1.50” (up to 2.00”)

4/21/2017 1.75”

4/11/2016 1.50” (up to 2.50”)

3/23/2016 1.25” (up to 2.00”)

4/27/2014 1.25”

4/3/2014 1.75”

Based on the Borgen case, the relevant “inception of loss” date would be the most recent hail storm on November 10, 2021, and each specific storm prior to that. This would mean any claims potentially implicating the events on May 18, 2019, and earlier could be time-barred, assuming your prior insurance policies contain the one-year filing limitation mentioned above. Given the number of equivalent hail strikes over the course of those eight years, you will likely have an uphill battle under Lowen Valley View in attributing the recent April 2021 and November 2021 storms to a loss under your current policy.

Even if it were somehow possible to assign each item of roof damage to a particular hailstorm—and further that statute of limitations issues would not limit recovery almost entirely—the number of storms creates another problem. With 11 storms occurring over the life of your roof, the insurer could argue that would mean 11 separate occurrences, which in turn would mean having to go through 11 separate deductibles before you ever saw a single dollar of insurance proceeds. Depending on the amount of your deductible, this means recovery could be impossible as a practical matter.

Read together, these rulings put the onus on business owners in areas at risk for hail damage to proactively conduct at least annual inspections to determine the existence of any roof damage potentially attributable to a particular insurance policy. It further puts the onus on business owners to understand the insurance claim process, including seeking tolling agreements to extend the deadline for filing a lawsuit.

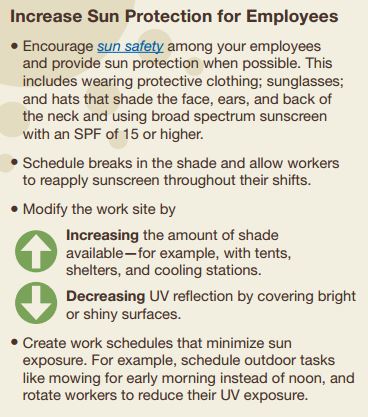

damage connective tissue and increase the risk for developing skin cancer; UVB, which doesn’t penetrate as deeply into the skin, but can still cause some types of skin cancer; and natural UVC, which is absorbed by the atmosphere and does not pose a risk.

damage connective tissue and increase the risk for developing skin cancer; UVB, which doesn’t penetrate as deeply into the skin, but can still cause some types of skin cancer; and natural UVC, which is absorbed by the atmosphere and does not pose a risk.