The New York Times today published the best, most comprehensive, most anger-inducing piece I have seen detailing the collective risk management failings that led to the Gulf oil spill. Clocking in at around 6,500 words, this thing is a doozy. But it is a report that everyone who wants to understand how this disaster really came to be needs to read.

The article focuses mainly on the failure of “blowout preventer,” a device attached to every well drilled in order to, you guessed it, prevent blowouts. While immensely complex and huge — it’s five stories tall and weighs hundreds of thousands of pounds — its purpose is to provide a shut-off method in case something goes wrong with the well.

Even more specifically, we get a wonderful lesson into the ultimate fail-safe: the “blind shear ram.” There are many components within the blowout preventer that must operate properly to shut off a well, but the blind shear ram is the final device that ultimately seals the thing. If it fails, the whole thing fails.

And all evidence is pointing to the fact that, on the Deepwater Horizon, it failed.

The process to activate the blind shear ram and seal the pipe is complex, but according to this article, the risks associated with that complexity were well known by all the players in the drilling industry. And on the Deepwater rig, no one did all that much to mitigate that risk. In contrast, in other instances, other companies and other rigs adopted redundancy as a way to ensure that a well shut-off would not be compromised.

Weaknesses were understood inside the oil industry, documents and interviews show. And given the critical importance of the blind shear ram, offshore drillers began adding a layer of redundancy by equipping their blowout preventers with two blind shear rams.

By 2001, when Transocean, now the world’s largest offshore drilling contractor, acquired the Deepwater Horizon, it had already begun equipping its new rigs with blowout preventers that could easily accommodate two blind shear rams.

Today, Transocean says 11 of its 14 rigs in the gulf have two blind shear rams. The company said the three rigs that do not were built before the Deepwater Horizon.

Likewise, every rig currently under contract with BP, which had been renting the Deepwater Horizon, comes with blowout preventers equipped with two blind shear rams, according to BP. While no guarantee against disaster, drilling experts said, two blind shear rams give an extra measure of reliability, especially if one shear ram hits on a joint connecting two drill pipes.

“It’s kind of like a parachute — it’s nice to have a backup,” said Dan Albers, a drilling engineer who is part of an independent investigation of the disaster.

In short, there were known issues with the ultimate, industry-standard fail-safe measure to prevent this type of spill. And in many cases — even most of those cases involving rigs constructed by Transocean and operated by BP — those issues were recognized and managed. But on the Deepwater Horizon, the most common method of managing that risk (redundancy) was not implemented.

Read into that whatever you like.

In fairness to BP and Transocean (something that’s hard to even try to provide anymore if I’m being honest), there is much, much, much, much, much more to all this. For example, the federal offshore drilling regulatory agency, the Minerals Management Service, knew all about these very same risks and never adequately ensured that any company do anything about them.

The federal agency charged with regulating offshore drilling, the Minerals Management Service, repeatedly declined to act on advice from its own experts on how it could minimize the risk of a blind shear ram failure…Even in one significant instance where the Minerals Management Service did act, it appears to have neglected to enforce a rule that required oil companies to submit proof that their blind shear rams would in fact work.

There is also ton of evidence that blowout preventers and blind shear rams — inherently — aren’t that great at stopping a well on an industrywide basis.

Using the world’s most authoritative database of oil rig accidents, a Norwegian company, Det Norske Veritas, focused on some 15,000 wells drilled off North America and in the North Sea from 1980 to 2006. It found 11 cases where crews on deepwater rigs had lost control of their wells and then activated blowout preventers to prevent a spill. In only six of those cases were the wells brought under control, leading the researchers to conclude that in actual practice, blowout preventers used by deepwater rigs had a “failure” rate of 45 percent.

Plus, there’s this:

More than three decades ago, the failure of a shear ram was partly to blame for one of the largest oil spills on record, a blowout at the Ixtoc 1 well off the Yucatan Peninsula in Mexico. Descriptions of the accident at the time detailed problems both with the shear ram’s ability to cut through thick pipe and with a burst line carrying hydraulic fluids to the blowout preventer.

In 1990, a blind shear ram could not snuff out a major blowout on a rig off Texas. It cut the pipe, but investigators found that the sealing mechanism was damaged. And in 1997, a blind shear ram was unable to slice through a thick joint connecting two sections of drill pipe during a blowout of a deep oil and gas well off the Louisiana coast.

Honestly, I could excerpt this whole article. It details so many instances where so many industry players did so little to solve the so very well known risks of drilling.

So infuriating.

So … really, you should just go read it in full. Additionally, here is the accompanying Times video that helps explain what exactly a blind shear ram is and how it works — in theory, of course.

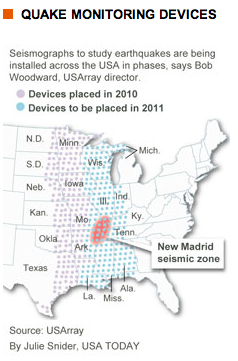

especially in the Pacific Northwest, an area that has experienced considerable seismic activity within the last several years. The information gathered will not only help scientists understand earthquakes, but will also educate residents of those areas about the dangers of such a catastrophe and could also lead to stricter building codes in such places.

especially in the Pacific Northwest, an area that has experienced considerable seismic activity within the last several years. The information gathered will not only help scientists understand earthquakes, but will also educate residents of those areas about the dangers of such a catastrophe and could also lead to stricter building codes in such places.