Wyoming’s decades-long oil and gas boom has drawn thousands of people to the state for high-paying — but dangerous — jobs.

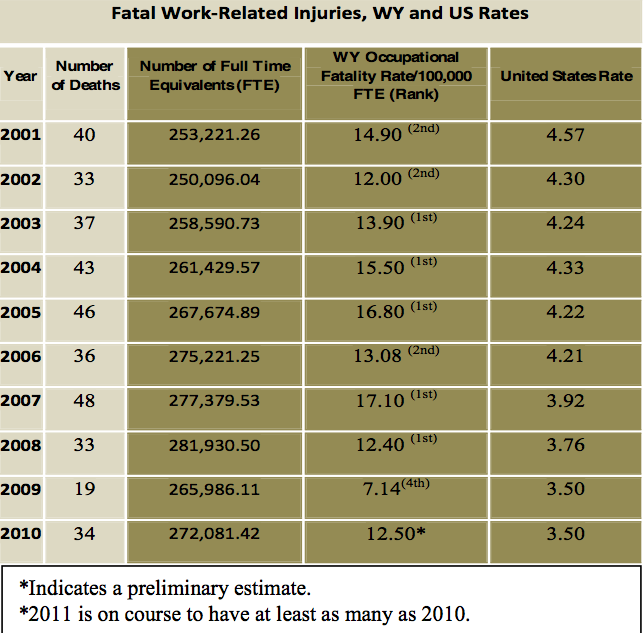

It was the alarmingly high rate of fatal on-the-job accidents that prompted former Governor Dave Freudenthal to put together the Workplace Safety Task Force consisting of members from the major industries in Wyoming as well as several state agencies. The task force hired Dr. Timothy Ryan, an occupation epidemiologist, to look into the problem and provide possible solutions.

In analyzing 17 years of occupation fatality data (1992-2008), Dr. Ryan found that:

The common theme throughout is the lack of a “culture of safety” in Wyoming. The following is a summation of what the employees described as their typical work environment:

- There is a breakdown in communication between the upper management, supervisors, and employees regarding safety.

- “Often the safety training that we receive is not enforced on the work site.

online pharmacy biaxin with best prices today in the USA”

- Employees are told to “get the job done” and safety protocol and rules are not enforced, resulting in injuries and fatalities.

- On any one job site, there can be a wide range in the safety standards.

In what can only be termed “shocking,” the report claims that based on the total number of fatalities, Wyoming averaged a fatality “every 10 days of the last 10 years.”

As the statistics indicate, the state of Wyoming is in dire need of solution to this problem. Dr. Ryan suggested the following:

- Organize and develop continuity of ongoing efforts.

- Develop data monitoring system for the collection and timely analysis of occupational data.

online pharmacy xifaxan with best prices today in the USA

- Promote OSHA courtesy inspections.

- Support efforts by industry to develop, monitor and enforce safety standards and practices.

The implementation of these suggestions will hopefully take Wyoming off the list of “most dangerous states to work.”