There are no shortage of Wall Street firms that want to strip some teeth from the Dodd-Frank financial reform act. But energy companies also have some incentive to parse out at least one key provision.

The item at issue, Section 1504 of Dodd-Frank, centers on transparency. Specifically it would, according to Bloomberg Businessweek, use SEC rules to force publicly traded energy/mining companies “to make timely, detailed disclosures of the tax and royalty payments they make to governments worldwide.” What is the specific arrangement agreed upon by, say, ExxonMobil and the government of Chad for the energy giant to pump oil from the resource-rich nation?

Businessweek notes how Chad, specifically, had much of its wealth pilfered by corrupt leadership. Proponents of Section 1504 hope that mandating greater transparency of these deals will keep the blame-less citizens of poor, resource-rich countries from having their country’s resources sold away to the highest bidder for the personal gain of their crooked rulers.

Now, Exxon and most other big energy companies say they aren’t against this concept in principle. As much as history has certainly helped them benefit from he actions of corrupt governments in the developing world, they have realized that transparency and “information sharing can improve governance,” according to Businessweek.

Their main issue seems simple: they already do this.

Large oil and mining companies already participate in a voluntary regime, the Extractive Industries Transparency Initiative. Executives at ExxonMobil, the world’s biggest oil company, have sat on the Initiative’s board.

buy chloroquine online www.methanol.org/wp-content/uploads/2022/08/png/chloroquine.html no prescription pharmacyReformers have been frustrated by the slow and incomplete nature of the disclosures required by EITI; Dodd-Frank is a chance to push through tougher rules. Lobbyists are now urging the SEC to delay action or to narrow the kinds of disclosures that would be required.

The American Petroleum Institute, the industry’s Washington arm, is leading the push, but all major oil and mining companies have joined in on their own. (Newmont Mining is the only major exception; it has expressed support for the 1504 rules.)

The question is whether or not this voluntary effort is enough.

Those in favor of Section 1504 say that the mandatory regulations go further and would better ensure that everything is reported and those living in poor, resource-rich nations are protected.

That is probably hard to argue with.

Big Oil, however, argues that the rules would be overly onerous.

The companies argue that the proposed rules would be “excessively burdensome,” in the words of Patrick Mulva, ExxonMobil’s vice president and controller. Big Oil’s “greater concern,” as Mulva wrote in a letter to the commission, is that 1504 would have a “detrimental effect” on the “global competitiveness of U.S. companies.” The fear is that Chinese, Russian, Brazilian, and Indian oil and mining companies, lacking qualms and unburdened by Dodd-Frank rules, would exploit the financial disclosures made by their Western competitors to outbid them—and potentially persuade leaders of resource-rich countries in the developing world to stay away from U.S. companies altogether.

Like all things with the rolling implementation of Dodd-Frank, I’m sure that there will be more to come on this … slowly.

Perhaps most interestingly to me, however, the article also compares this provision to the Foreign Corrupt Practices Act, which was passed by Congress in 1977 to stamp out the rampant bribery of foreign government office that goes on between U.S. companies operating abroad.

A generation ago, Congress insisted when it passed the Foreign Corrupt Practices Act that U.S.-headquartered multinationals would be held to a special standard, forgoing bribery even where it was commonplace abroad, and would have to learn how to compete with unscrupulous Russian, Chinese, or French companies. Not only did American business survive and thrive after the law was passed, but forward-thinking American executives learned to use the law to fob off outstretched hands and avoid unsavory rents they wouldn’t have wished to pay in the first place.

That may be true.

But companies are now facing an increased enforcement of the FCPA. We just finished edited a story for our June issue about how companies can insure themselves against Justice Department FCPA investigations. There are a lot of nuanced, policy-language questions that come into play if a claim is triggered. It is some very arcane stuff, frankly.

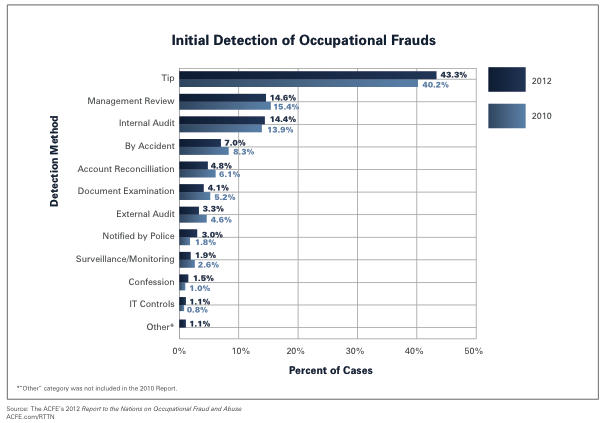

But what is notable is seeing how the enforcement has increased. Here are two charts that tell the story.