Global insurance rates declined for the 15th consecutive quarter, remaining competitive for most of 2016, according to the Marsh Global Insurance Market Index, Q4, 2016, which tracks industry data.

Insurance rate decreases moderated in the fourth consecutive quarter as global property rates continue to drop at a greater rate than other lines, mainly due to overcapacity and a lack of insured losses, according to the report.

“The last quarter of 2016 marked the 15th consecutive quarter in which average rates declined, largely due to a market with an oversupply of capacity from traditional and alternative sources and a lack of significant catastrophe losses,” Dean Klisura, global industry specialties and placement leader at Marsh, said in a statement.

After peaking at a 5% global quarterly rate of decline during the fourth quarter of 2015, that rate moderated throughout 2016. “The fourth quarter of 2016 marked an entire year (four consecutive quarters) in which the average rate of decline for global insurance rates moderated—a first since Marsh initiated the index in 2012,” says the report.

Worldwide, rates declined by 3.1% while the U.K. and Continental Europe saw the greatest regional drops at 4.8% and 4.2% respectively. Latin America saw the smallest regional drop at just 0.5% as the U.S., Asia and Pacific regions hovered midway with declines of 3.0%, 2.7% and 2.2%, respectively.

By business line, global casualty lines had the slowest rate decline at 1.9%, followed by Marsh’s Global FinPro (financial and professional) at 3.0% and then global property with the largest decline of 4.2%. U.S. rate declines reflected global figures with U.S. casualty rates declining in the fourth quarter at a rate of 2.1%, U.S. FinPro at 2.5% and U.S. property at 4.8%.

By contrast, the Marsh report tracked rising U.S. cyber liability rates, up 1.4% for Q4 2016, which was actually the smallest increase since rates started rising in Q3 2014 at a rate of 4.8% before peaking at 20.0% in Q2 2015, then beginning a steady decline toward the latest quarter. Despite steadily rising cyber liability rates, the report notes that “the number of clients purchasing cyber insurance increased 25% from 2015 to 2016 across all industries, with the greatest overall take-up in healthcare, communications, media and technology.”

Insurance markets in the U.K. and Continental Europe remain competitive, the report said, as Latin American casualty and financial and professional liability rates increased. Casualty rate increases were largely due to rising auto insurance prices, particularly in Colombia and Mexico, where Marsh says it has a large market share.

Some rates in the Pacific region notched increases, with casualty rates up 0.4% and financial and professional liability rates up 1.7%. Asia’s commercial insurance market remains competitive, according to the report.

While the report appeared to paint an overall picture of industry-wide softness, there was some suggestion of a turn in the tide. “Early indications that capacity may be moderating and that combined ratios may be increasing could be harbingers of looming rate increases as carriers seek to boost profitability and keep combined ratios below 100%,” Marsh says in its report.

In addition to looking back with its rates report, Marsh also takes a look forward in its “U.S. Financial and Professional Market in 2017: Our Top 10 List.” The company states that decreases in the directors and officers insurance market, continue “nine straight quarters of rate decreases.”

The Top 10 list goes on to say that cyber insurance will evolve as “risk professionals will need to address evolving cyber risks across multiple platforms,” and adds that financial and technology industries are converging at an increasing pace. “Financial companies will increasingly see exposures that were historically the domain of the technology industry,” it says.

In its “Casualty Insurance Outlook: Good News for Buyers in 2017,” Marsh says 2017 is “generally a buyer’s market for casualty insurance buyers, who typically are seeing strong competition and ample capacity for most casualty lines.”

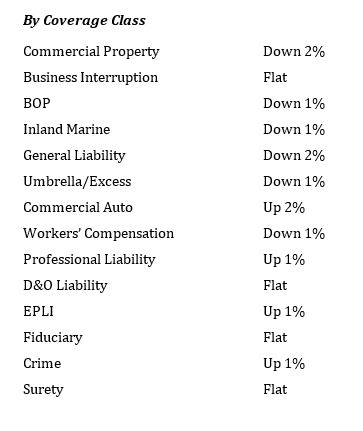

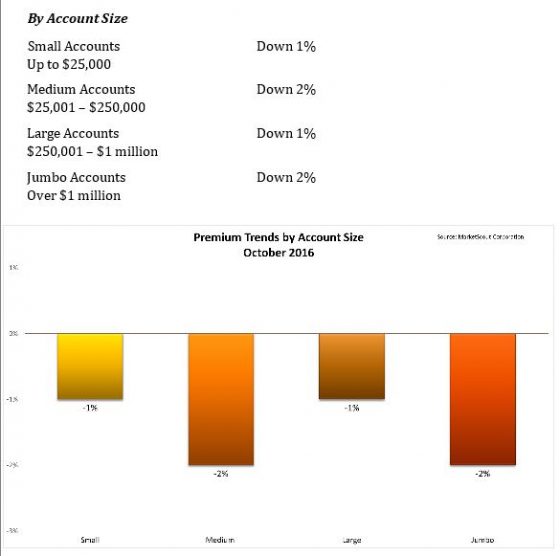

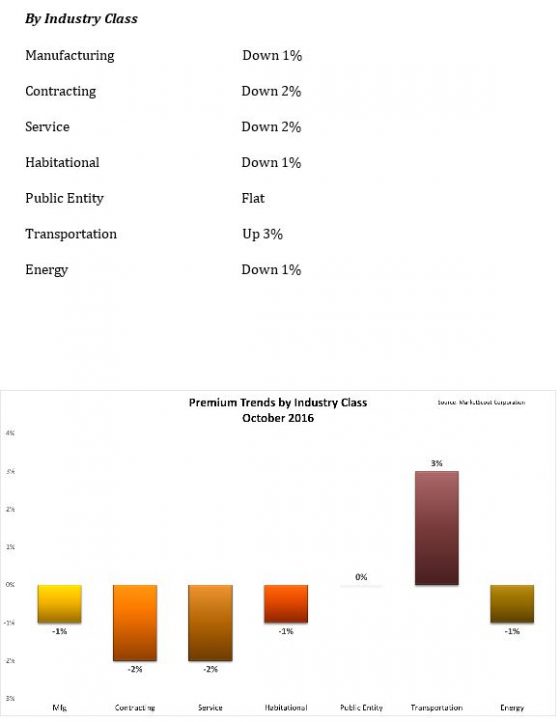

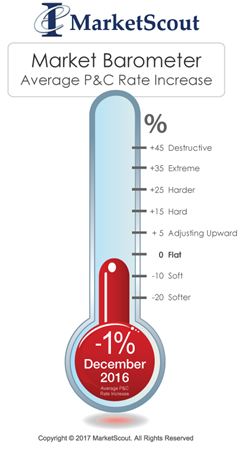

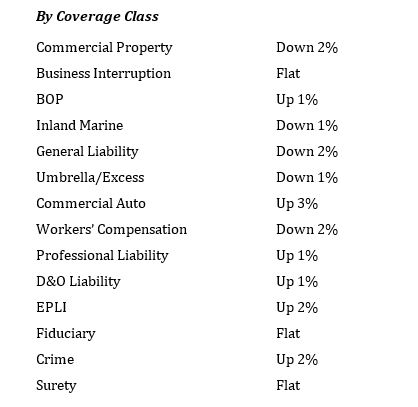

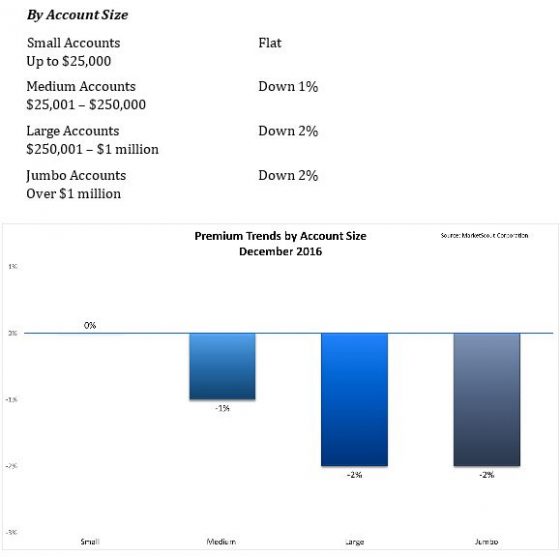

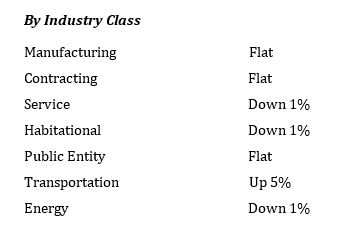

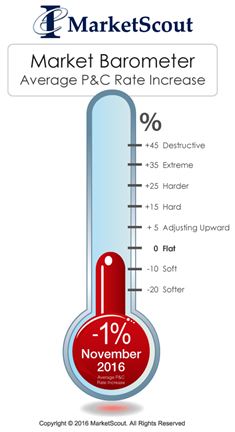

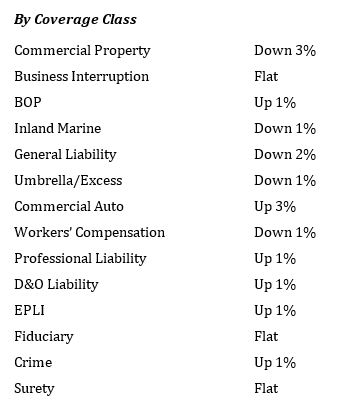

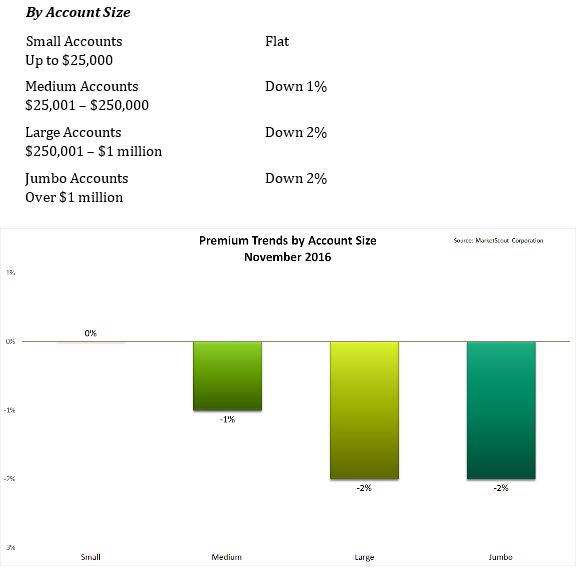

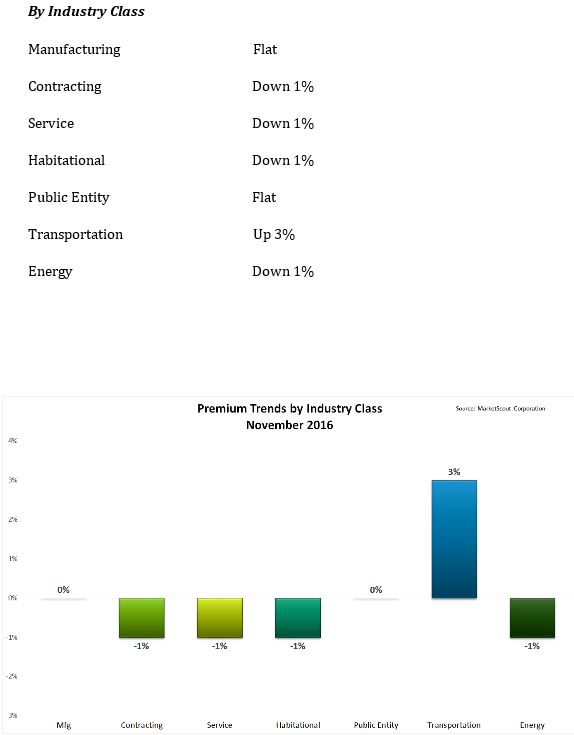

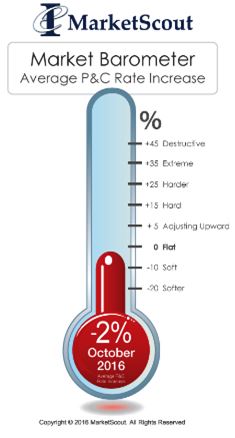

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

according to MarketScout.

according to MarketScout.

rates were down 2% compared to down 1% in June, July, August and September, according to

rates were down 2% compared to down 1% in June, July, August and September, according to