Less than three weeks after oral argument, the Sixth Circuit affirmed a lower court order granting summary judgment in favor of Kaplan in one of the EEOC’s most high profile cases – EEOC v. Kaplan Higher Education Corp.

The EEOC brought suit against Kaplan for using credit-checks in its hiring process – “the same type of background check that the EEOC itself uses” the Sixth Circuit pointed out – claiming that the practice had a disparate impact on African Americans.

On Jan. 28, 2013, Judge Patricia A. Gaughan of the U.S. District Court for the Northern District of Ohio granted summary judgment in favor of Kaplan, finding that the EEOC’s statistical evidence of disparate impact was not reliable and not representative of Kaplan’s applicant pool as a whole. (Read more about that ruling here.)

The Sixth Circuit found no abuse of discretion. The EEOC’s “homemade” methodology for determining race – by asking its “race raters” to label photographs – was, in the Sixth Circuit’s words, “crafted by a witness with no particular expertise to craft it, administered by persons with no particular expertise to administer it, tested by no one, and accepted only by the witness himself.”

Background

The EEOC filed suit against Kaplan alleging that Kaplan’s use of credit-checks causes it to screen out more African-American applicants than white applicants, creating a disparate impact in violation of Title VII.

In support of its allegations, the EEOC relied on statistical data compiled by Kevin Murphy. Because Kaplan’s credit check process was race-blind, the EEOC subpoenaed records regarding Kaplan’s applicants from state departments of motor vehicles. Thirty-six states and the District of Columbia provided color copies of approximately 900 drivers’ license photos.

Murphy assembled a team of five “race raters” and directed them to review the photos and classify them as “African-American,” “Asian,” “Hispanic,” “White,” or “Other.” Murphy also provided the raters with applicant names.

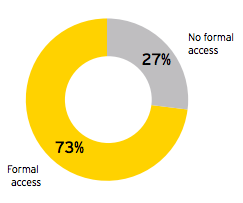

Based on the results of this “race rating,” Murphy opined that, in a sample of 1,090 (out of 4,670 applicants), the percentage of black applicants who were flagged for review based upon their credit histories was higher than the percentage of white applicants who were flagged.

The district court excluded Murphy’s testimony as unreliable for two reasons. First, the EEOC presented “no evidence” that Murphy’s methodology satisfied any of the factors that courts typically consider in determining reliability under Federal Rule of Evidence 702; and second, as Murphy himself admitted, his sample was not representative of Kaplan’s applicant pool as a whole. The district court granted summary judgment in favor of Kaplan, and the EEOC appealed.

The Sixth Circuit’s Opinion

The Sixth Circuit affirmed. The Sixth Circuit noted that, as the proponent of expert testimony, the EEOC bears the burden of proving its admissibility. It determined that the district court did not abuse its discretion in finding that the EEOC failed to make such a showing.

The EEOC argued that the district court erred in finding that it had “wholly fail[ed]” to provide evidence that its technique had been tested or had any “known or potential rate of error.” The EEOC contended that it provided such support in the form of “anecdotal corroboration.” That is, as to 57 applicants, Murphy cross-checked his raters’ classifications with racial identifications provided by a DMV or Kaplan.

The Sixth Circuit noted that the EEOC’s cross-check yielded an 80% match – “an unimpressive correlation in case where a few percentage points (in credit-check fail rates for blacks and whites) might make the difference between significant liability and none.” In any event, as Murphy himself conceded, a mere 57 instances of anecdotal corroboration is “not enough” to establish the reliability of his photo rating methodology.

As the Sixth Circuit found, “[t]he EEOC’s case goes downhill from there.” The EEOC failed to present evidence that its technique was subjected to peer-review or publication, failed to show that Murphy employed standards to control “the technique’s operation,” and presented no evidence that Murphy’s race-rating methodology was “generally accepted in the scientific community.” The raters themselves “had no particular standard in classifying each applicant; instead, they just eyeballed the DMV photos.”

Finally, as an independent ground for excluding Murphy’s testimony, the district court found “no indication” that Murphy’s group of 1,090 applicants was representative of the applicant pool as a whole. The Sixth Circuit noted that, “[i]nstead there is a strong indication to the contrary: Murphy’s group had a fail rate of 23.8%, whereas the GIS applicant pool had a fail rate of only 13.3%.” It held that an unrepresentative sample “by definition” might skew the respective fail rates of black and white applicants in the larger pool – “and thus is not a reliable means to demonstrate disparate impact.”

Implications

In its opinion, the Sixth Circuit staunchly critiqued the EEOC’s “do as I say, not as I do” litigation tactics. It noted (in the first line of its opinion) that the EEOC “sued the defendants for using the same type of background check that the EEOC itself uses.” It also noted, as the district court observed, that “the EEOC itself discourages employers from visually identifying an individual by race and indicates that visual identification is appropriate ‘only if an employee refuses to self-identify.’”

This blog was previously published by Seyfarth Shaw LLP.