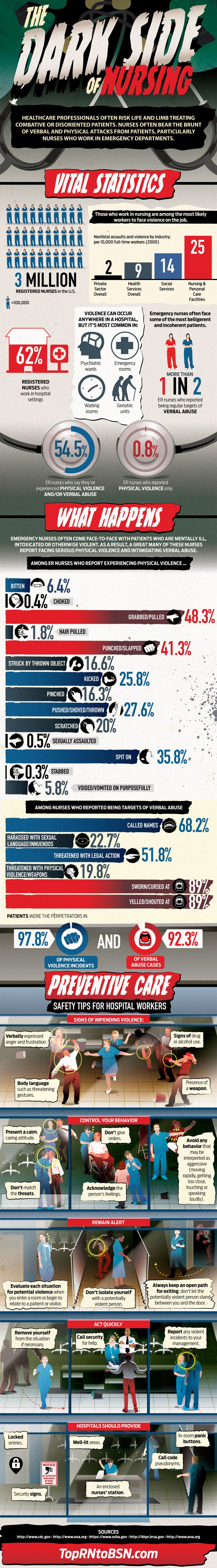

In “Bad Medicine,” from the December issue of Risk Management magazine, Alan H. Rosenstein wrote about managing the risk of disruptive behaviors in health care settings, which he defined as “any inappropriate behavior, confrontation or conflict, ranging from verbal abuse to physical or sexual harassment, that can negatively impact patient care.

buy symbicort online https://galenapharm.com/pharmacy/symbicort.html no prescription

” More than half of respondents in one survey felt these events led to medical errors and compromises in patient safety and quality of care, Rosenstein reported.

But the risks nurses face do not just come from within the staff—simply doing their jobs presents a minefield of potential danger to physical and mental health. According to the Occupational Safety and Health Administration, those who work in nursing are the most likely to face violence on the job. Over 54% of emergency room nurses report experiencing physical violence or or verbal abuse on the job, of whom 41% report they have been punched or slapped at work and almost 28% report being pushed, shoved or thrown.

Nearly 98% of physically violent incidents against nurses are perpetrated by patients, who are also responsible for 92.

3% of verbal abuse in the health care setting.

Check out the infographic below for more details on the risks nurses face, and some preventative best practices to minimize risk for hospital workers:

Source: TopRNtoBSN.com