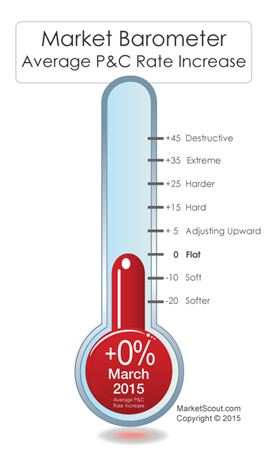

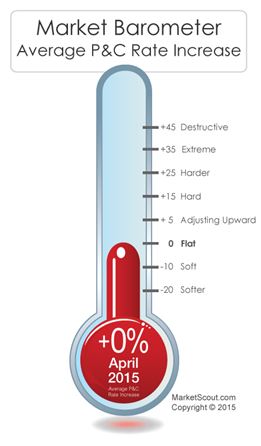

Property/casualty insurance buyers are continuing to see flat rates, as all lines of coverage averaged a zero percent rate change, MarketScout reported today.

“The market continues to be trending downward over the last eight months, from October 2014 at plus 1.5% to April 2015 at a zero percent increase,” Richard Kerr, CEO of MarketScout said in a statement. “It’s not dramatic but it is a trend. Coastal property may experience some slight rate increases since we are on the cusp of the wind season. Rates on all other exposures should continue to be quite competitive.”

1.5% to April 2015 at a zero percent increase,” Richard Kerr, CEO of MarketScout said in a statement. “It’s not dramatic but it is a trend. Coastal property may experience some slight rate increases since we are on the cusp of the wind season. Rates on all other exposures should continue to be quite competitive.”

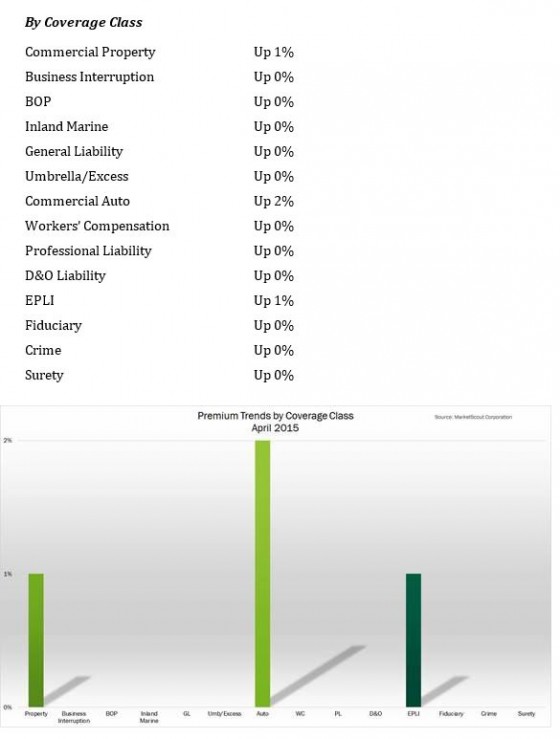

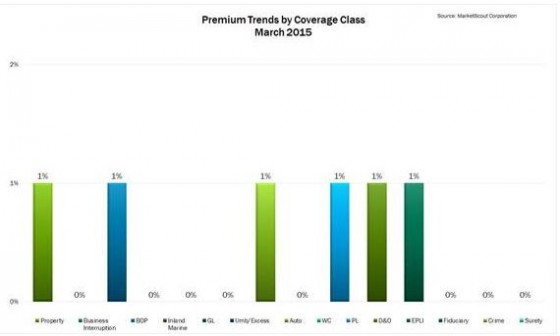

When measuring rates by coverage classification, automobile coverage was up to plus 2%. Rates for all other coverages remained the same. Business owners policies (BOP), professional liability and D&O coverages decreased in April 2015 by 1% compared to March 2015, according to MarketScout, an insurance distribution and underwriting company.

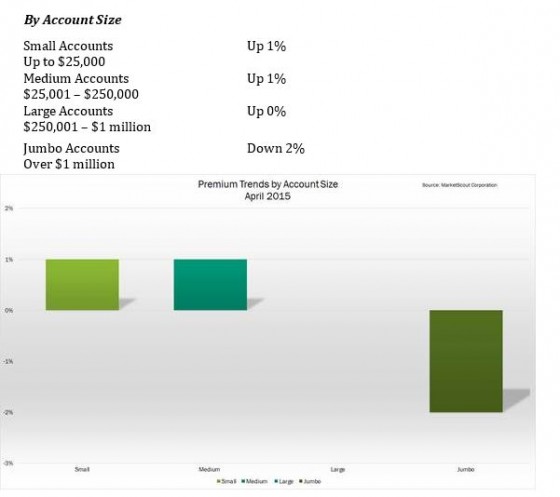

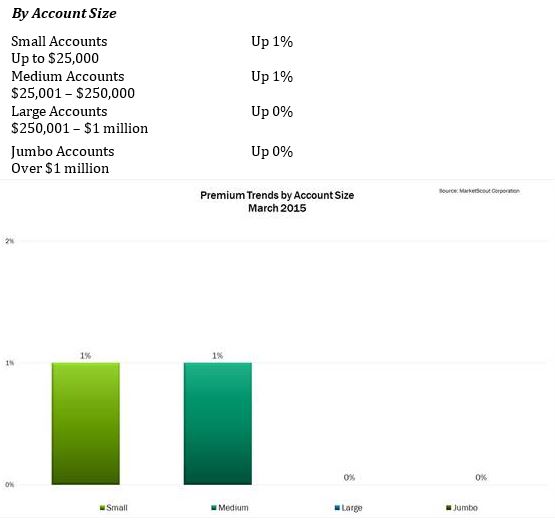

By account size, rates remained the same for all, except jumbo accounts of more than $1,000,000 premium. These accounts adjusted to a reduction of minus 2% in April 2015, compared with rates in March 2015.

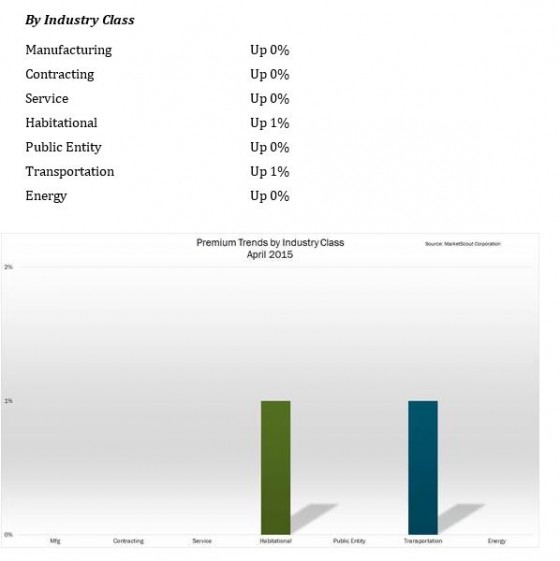

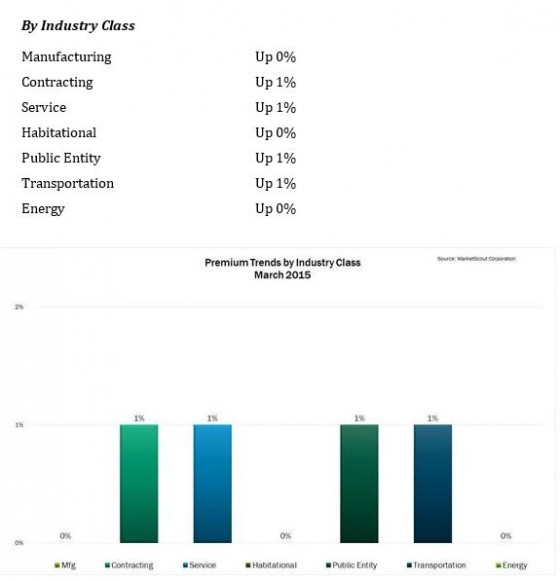

Industry classifications were all reported at a zero rate increase in April 2015 with the exception of transportation, which held steady at a rate increase of plus 1% and habitation, which increased from 0% in March to plus 1% in April, MarketScount said.

Summary of April 2015 rates by coverage, account size and industry class: