The trend of building homes in isolated wooded areas has been increasing across the United States. This urbanization of woodlands has changed the way forests are managed. Small wildfires that were once allowed to burn out are now suppressed to protect homes and buildings. Added to this are drought conditions exacerbated by climate change. All of these factors have increased the likelihood of wildfires.

The United States Forest Service (USFS) notes that 32% of the housing units in the U.S. and one-tenth of all land with housing are situated in the Wildland-Urban Interface (WUI). The largest cost driver for both Federal and State wildfire suppression operations is the protection of public and private property in the WUI, according to the USFS.

The “Wildland-Urban Interface Federal Risk Mitigation Executive Order 13728,” released in 2016 by the Federal Emergency Management Agency (FEMA), reported that:

In 2015 alone, more than 10 million acres of wildlands burned, requiring the service of more than 27,000 firefighters and resulting in $2.1 billion spent by the USFS and the Department of the Interior (DOI) to suppress the fires—a record amount. Over the last decade, the fire season has become 2.5 months longer, and fires covering more than 10,000 acres increased, with the average area burned by wildland fires doubling in the last three decades to an estimated seven million acres per year.

This year, more records were broken. In California, the Mendocino Complex Fire became the largest wildfire ever recorded in the state, according to the California Department of Forestry and Fire Protection, or Cal Fire.

According to FEMA, 46 million homes in 70,000 communities are at risk of WUI fires, which have destroyed an average of 3,000 structures annually over the past decade. As more people move into the WUI, businesses follow, putting organizations and jobs at risk.

To protect structures from fire, especially those in the WUI, the Insurance Institute for Business & Home Safety (IBHS) recommends that protection should take into account for a building’s materials and design features—as well as the selection, location and maintenance of landscape plants, including grasses, shrubs, bushes and trees.

According to IBHS, a defensible space should be maintained around a building to reduce wildfire threat and help a building to survive without assistance from firefighters. A vegetation management plan (VMP) also needs to be put in place, particularly in WUI areas. A VMP provides important information about the land, such as:

- Topography (slope and aspect)

- Location of building(s) on the land

- Proposed fuel treatment details (suggested actions such as thinning and prescribed burning to minimize wildfire risks)

- Environmental concerns (such as threatened and endangered species, state-listed sensitive species and wetlands)

The VMP also provides detailed information on how the three defensible space zones will be developed and maintained. When developing a VMP, IBHS recommends consulting a landscape professional such as a forester, range manager, or natural resource specialist.

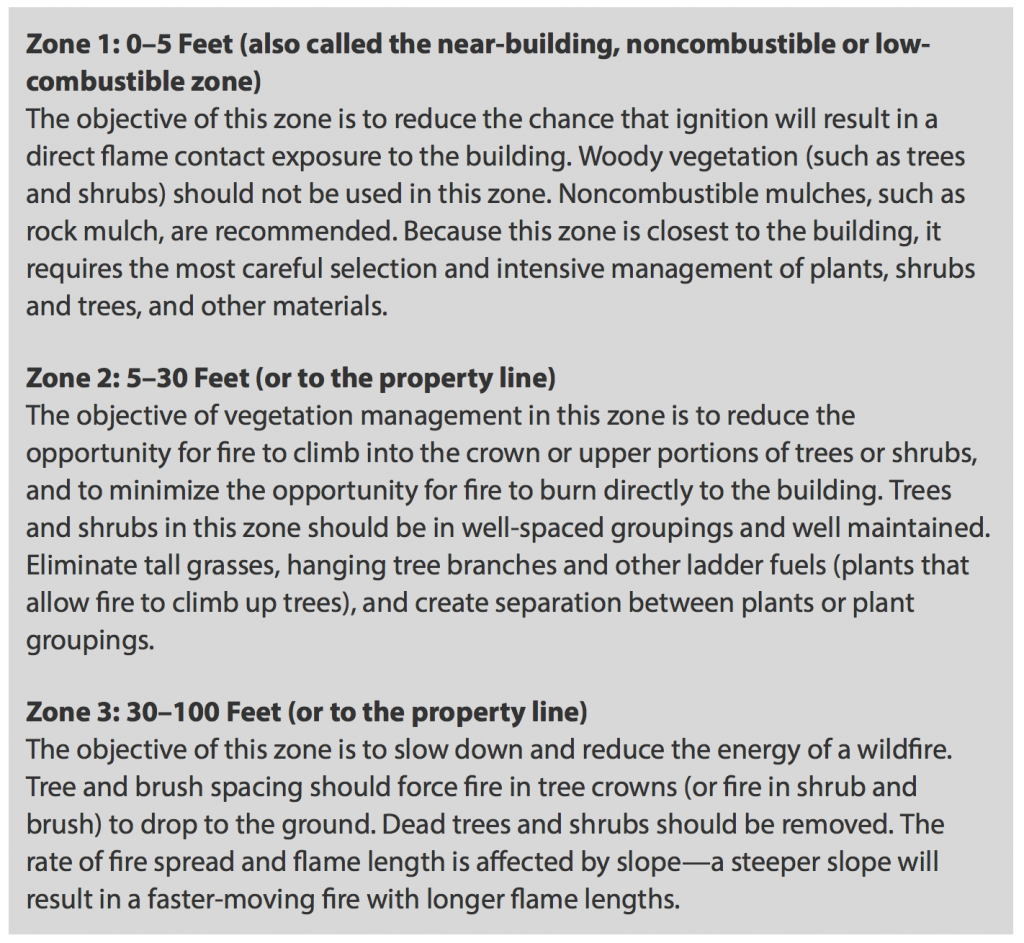

IBHS recommends creating three defined areas around a building called defensible space zones. Each zone has specific recommendations for the types of plants used, including how they should be grouped and maintained.

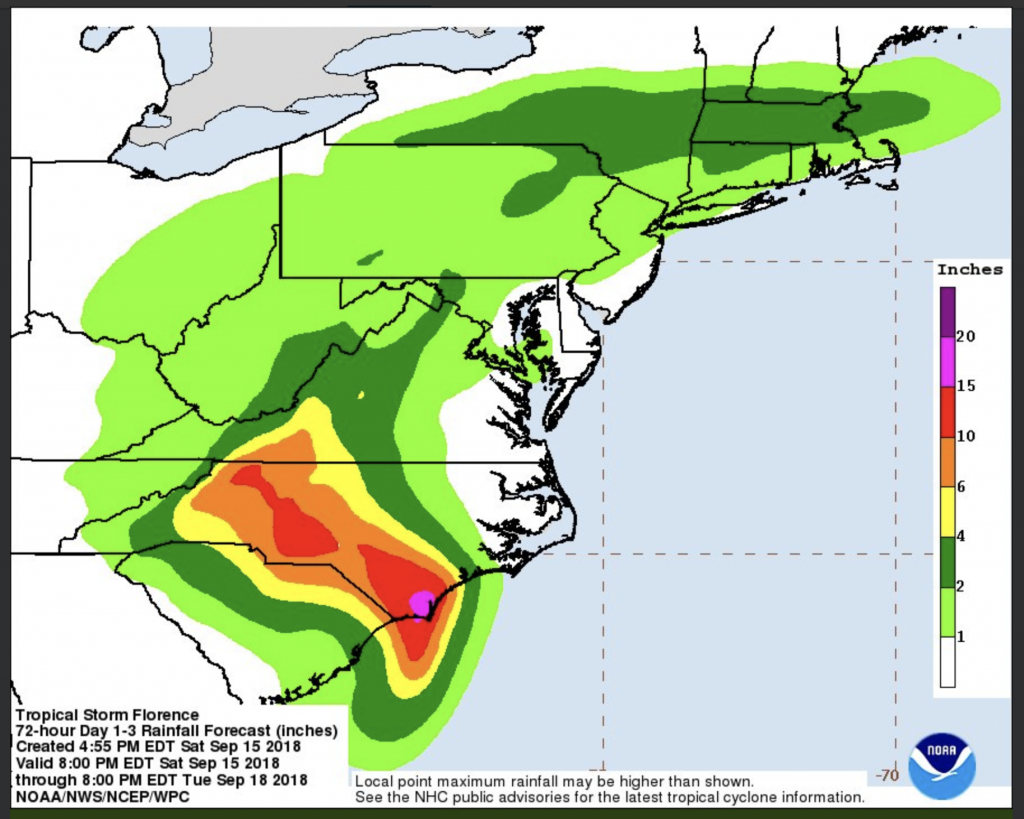

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Security scanners that screen passengers entering stations and terminals are being tested around the country and have been installed in subway stations in Los Angeles. The

Security scanners that screen passengers entering stations and terminals are being tested around the country and have been installed in subway stations in Los Angeles. The