In last week’s “RIMS Content Roundtable: COVID-19 Vaccines and Distribution,” a group of RIMS members gathered for an exclusive Q&A with Dr. Adrian Hyzler, chief medical officer at Healix International, who focused on progress with COVID-19 vaccination efforts and moving toward a “next phase” of the pandemic.

“Where we’re headed is: this pandemic will end—all pandemics end—but it doesn’t end all of a sudden, it goes out with a whimper…it sort of just seeps away at different rates around the world,” Hyzler said, noting the rates of vaccination and controls implemented country by country will curb the coronavirus at different paces. “But it’s now going to be an endemic disease, meaning it’s something we live with. We’re not going to get rid of this disease.”

He believes recognition among public health experts that COVID-19 will become endemic rather than be eradicated prompts new conversations about expectations and preparations around the world.

“The new dialogue is: what is the acceptable level of COVID and what is the acceptable level of deaths from COVID? Because COVID is a respiratory disease and people die of respiratory diseases every year, especially in winter. That’s something we live with,” Hyzler said. “We’re going to have to get to a point where there are going to be people who die from COVID every year, but they’re not going to overrun hospitals, and they’re not going to affect care of other diseases.”

Getting to the stage of “a disease we live with” requires mass vaccination, and he stressed the importance of the widespread effort to encourage people to get COVID vaccines as soon as possible. Scientists are not yet sure what percentage of the population will need to be fully vaccinated to control the pandemic sufficiently and, he said, “that’s vaccinated across the whole population evenly, and that’s not the case—we know there are communities where they are vaccine-hesitant, we know there are religious groups that are not as confident about the vaccine, and they tend to cluster, so those are always ready for outbreaks.”

Rather than discuss the sometimes controversial or scientifically debatable concept of “herd immunity,” Hyzler encouraged thinking about “community immunity.”

“‘Community immunity’ is good because it’s more about what we can do for each other,” he explained. “Getting vaccinated, for a 28-year-old, is not necessarily about that person, it’s about what it can do for the community—the older people, the people who have preexisting conditions that make them vulnerable.”

This kind of community orientation and widespread adherence to best practices will be critical in getting to any next phase of the pandemic, and to staying there. Reflecting on his experience of the acute lockdowns implemented in the U.K., for example, Hyzler stressed the lessons learned about the impact of mass adherence to mitigation and prevention measures. “Even with the variant that’s come out here that is very transmissible and has become common in the States, we’ve shown that non-pharmaceutical interventions—which are masks, distancing, isolation, hygiene—they work,” he said.

Many of these non-pharmaceutical interventions will not be going away any time soon—indeed, they may be just as critical moving forward. Hyzler predicted, “I think, into next year, we may still be wearing masks in many situations and there may be a great move to more things outdoors, since we know how much safer that is, and I think we’ll have learned a lot of things from this… Hopefully we’ll also be more ready for something that will happen again.”

As the world moves toward mass vaccination to help curb COVID-19, companies should be preparing for the next stage of the pandemic and creating detailed plans for safely returning to work. To that end, Hyzler noted some large private companies have publicly offered resources to help other enterprises protect employees and operations amid the pandemic and prepare for a return to workplaces.

For example, Ford has published two versions of a “Return to Work Playbook,” one for manufacturing and another for non-manufacturing companies. According to Ford, in addition to providing these documents to employees, “the company is also providing a copy to its suppliers, business partners and relevant third parties to ensure they are all aware of its health and safety practices when they are on site at Ford facilities or are interacting with Ford personnel.” Companies outside of Ford’s supply chain can also benefit, however.

“Add in some CDC advice, and look at what people [around you] are doing, because there are little things you can do that are very specific to your area or your workforce,” Hyzler recommended. “Then, take the information [from the playbook] that’s useful and mold it into a mini version of a playbook, if you’re a smaller company.”

In addition to the Ford playbooks Hyzler mentioned, check out these publicly available resources from the private and public sectors that may offer help in managing COVID-19 risks and creating a return-to-work plan for your enterprise:

Ford’s Return to Work Manufacturing Playbook [PDF]

Ford’s Return to Work Non-Manufacturing Playbook [PDF]

IBM’s Return to Workplace Playbook [PDF]

Kaiser Permanente’s COVID-19 Return to Work Playbook

CDC’s Guidance for Businesses and Employers Responding to Coronavirus Disease 2019 (COVID-19)

CDC’s “Daily Activities” Guide for Returning to Work

OSHA’s Protecting Workers: Guidance on Mitigating and Preventing the Spread of COVID-19 in the Workplace

Participants in the roundtable event were able to debrief with fellow risk professionals in breakout rooms, sharing impressions from the session and experience addressing related risks within their own organizations. For more opportunities to discuss return-to-work plans, vaccine considerations and other COVID-related risks with other risk professionals, all RIMS members can continue the conversation on Opis, the society’s community engagement and networking platform. Among almost 200 education sessions, the upcoming RIMS Live 2021 virtual conference will also offer dozens of COVID-related education and networking events from April 19 to 30, and registration is now open. To hear more insights directly from Dr. Hyzler, you can check out his appearances on the RIMScast podcast.

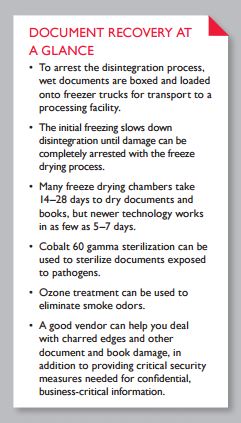

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.