On Earth Day 2020, risk professionals can reflect on ways to protect both the environment and their businesses. Worldwide, climate change poses countless risks, including increasing the frequency and magnitude of natural disasters, reducing access to resources and disrupting supply chains.

To celebrate Earth Day and help risk management professionals address environmental risks and climate change, here is a roundup of some of our coverage from the past year about these critical topics:

From Risk Management Magazine:

Aligning Sustainability and Risk Management: A collaborative approach between sustainability and ERM can best drive real change.

Taking Action on Climate Change: As the potentially devastating impacts of climate change become clear, risk managers must assess the resulting risk exposures and opportunities for their companies.

Insurers Divest from Coal Over Climate Risks: Insurers are pulling coverage and investments related to the mining and use of coal.

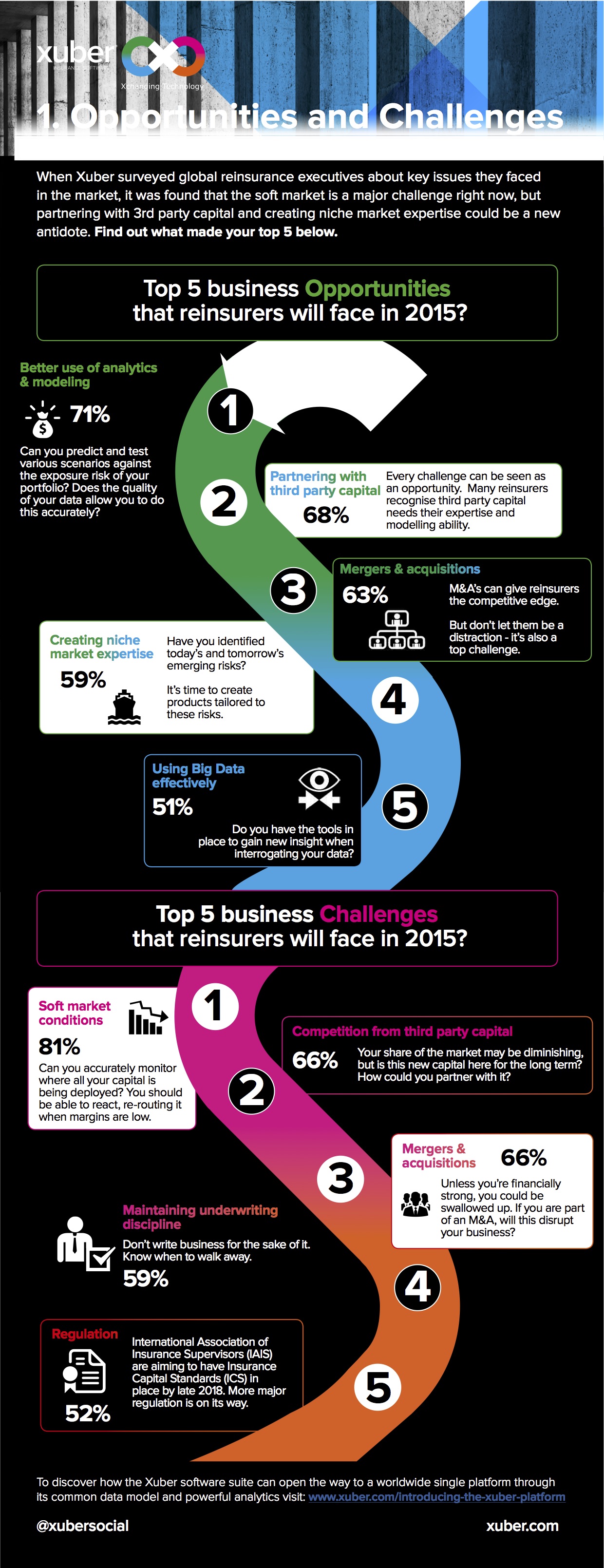

Will Climate Change Impact Reinsurance Rates?: As natural disaster losses mount, the reinsurance response could spur action on climate change.

Getting Serious About ESG Risks: Investors are increasingly scrutinizing environmental, social and governance activity.

From the Risk Management Monitor blog:

Venice Sees Near-Record Flooding: The city of Venice, Italy, faced the worst flooding of its famous canals since the devastating floods of 1966, suffering major economic impacts.

Catastrophic Floods More Frequent in 2019: Major flooding has become a normal occurrence for many regions of the country, and by all indications, it is becoming worse each year.

Global Heat Waves Signal Climate Risks: The pattern of dangerous heat waves has become a yearly occurrence across the globe.

Texas Study Shows Business Impact of Major Storms: The large storms hitting the coast of Texas are having serious impacts on industries across the state and country.

Limit Organizational Exposure During the Polar Vortex: Tips for protecting businesses during the frigid weather phenomenon.

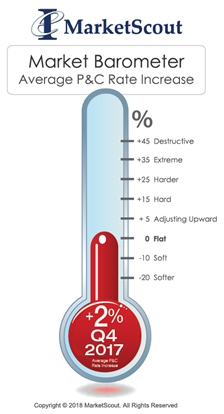

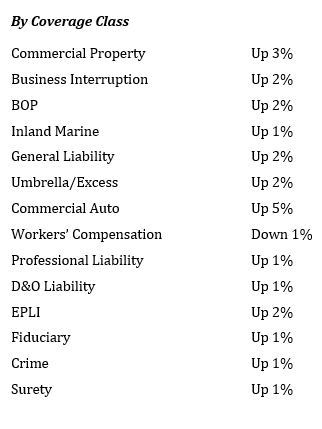

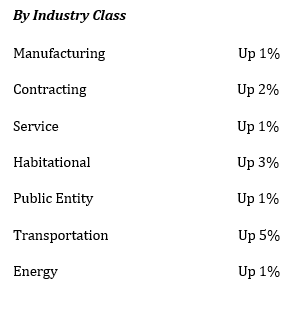

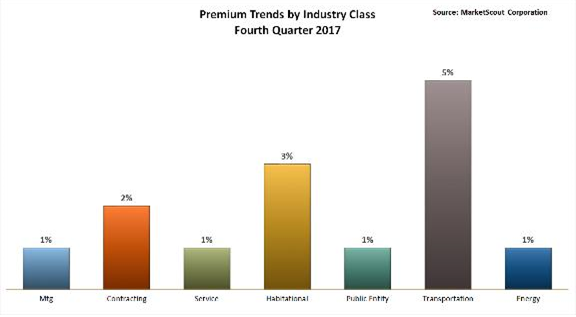

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

On average, underwriters assessed rate increases for all industry groups except transportation and public entities. “Keep in mind, rates are calculated on a composite basis and represent exposures from businesses across the U.S. Insureds in catastrophe exposed areas incurred higher rates/premiums,” Kerr said.

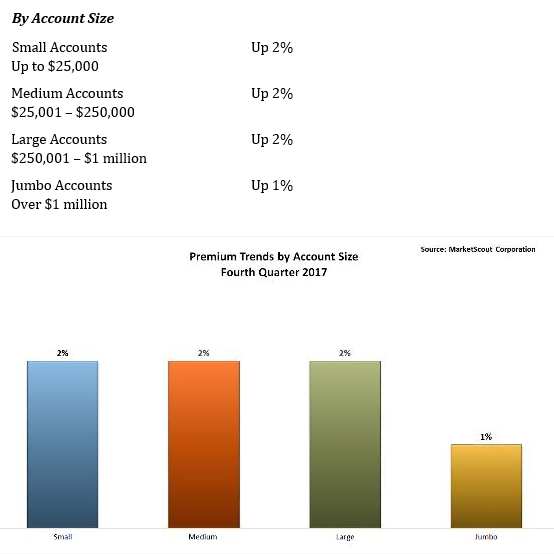

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.

MarketScout also noted that large accounts were seeing increases averaging 1%, while others saw 2% increases.